Corporate Litigation, Reputation and Top Executive Turnover—Considering the Moderating Roles of Political and Legal Conditions

2020-06-04WANGLuZHAOXiaokang赵晓康

WANG Lu (王 璐), ZHAO Xiaokang(赵晓康)

Glorious Sun School of Business and Management, Donghua University, Shanghai 200051, China

Abstract: With the rapid development of China’s economy, more and more listed companies have to face frequent corporate litigation. As corporate lawsuits are on the rise, it is necessary to study the measures taken by the company when a corporate litigation occurs. Some scholars’ research indicates that top executive turnover may be one of the countermeasures, but few scholars have discussed this issue in the Chinese market. Our research uses 13 435 samples of Chinese market, takes the company’s reputation as an observing point, and studies the relationship between corporate litigation and top executive turnover. In addition, due to the special political environment and the large differences in the legal environment between different provinces in China, we have further explored the moderating role of political conditions and legal conditions. It is worth mentioning that our empirical research method is the propensity score matching (PSM), and by this way we can easily avoid sample selectivity bias. Finally, a robust experimental conclusion is obtained: corporate litigation and top executive turnover are significantly positively correlated, and this correlation will be adjusted by political and legal conditions. Our research enriches the field of corporate litigation and also have certain guiding significance for the social construction of the rule of law in China.

Key words: company litigation; reputation; top executive change; propensity score matching (PSM)

Introduction

According to relevant statistics, Chinese economy has developed steadily in the 40 years of reform and opening up, and the number of lawsuits has gradually increased at an average annual growth rate of 10%[1]. The increase in litigation cases can be explained from two aspects: (1) the frequent economic and trade exchanges have made the legal relationship between the subjects more complicated, and the probability of conflicts and disputes has increased; (2) people’s awareness of the legal system has been continuously enhanced, the parties to a case dispute are more and more inclined to settle the dispute through litigation. The information in the Wind Database indicates that more than one third of listed companies in China has suffered corporate lawsuits in 2017. All the evidence suggests that the company, as a legal person, also faces an increasing trend of litigation.

Most previous researches on corporate litigation are based on the perspective of “risk management”. For example, Mao and Meng[2]believed that internal control could effectively prevent the occurrence of corporate litigation. Corporate litigation brings losses to the company from two main aspects. The first one is the economic loss. In corporate litigation, the losing company has to bear high legal costs and economic compensation, and even the winning party also faces the risk of certain economic losses, including the opportunity cost of resources being occupied, and the economic risk that resources cannot be fully recovered. The second one is the reputation loss. Company litigation means that conflicts and disputes are disclosed to the public. When the company is the wrong party, it will affect the public’s overall evaluation of the company, and even if the company is the victim, it will cause stakeholders to worry about the company’s current situation. Karpoffetal.[3]pointed out that the reputational cost of litigation might be more serious for the company than the economic cost. Company’s reputation loss will bring to the company a series of negative effects, including the company’s stock price[4], financing capacity[5], financial performance[6]and so on. After analyzing the lawsuits of listed companies in the wind database, this article found that the proportion of companies involved in lawsuits increased year by year. In addition, Zhao and Zhan[7]pointed out that China had been influenced by the Confucian culture for a long time and advocated the value concept of “no litigation”. This shows that under the special era trend and cultural background of China, the impact of corporate litigation on corporate reputation may be greater. The reputation loss will cause many troubles for the company operations. In this case, companies struggling in litigation will take a series of measures to reduce reputation loss which may be caused.

At present, domestic scholars have studied the multiple reactions of listed companies to corporate litigation from the perspective of reputation. Studies by Xieetal.[8]showed that after the corporate litigation occurs, in order to remove the “problematic” hat as soon as possible, the company will change its name. The research by Fu and Ji[9]believed that charitable donations can be regarded as a kind of “reputation insurance”. When the corporate litigation occurs, the level of charitable donations will be significantly improved, and this influence relationship will be regulated by the institutional environment and information environment. While researches by foreign scholars, in recent year, have focused on top executive changes. Aharonyetal.[10]showed that corporate litigation can affect changes in chief executive officers (CEOs), directors, and independent directors. Dou[11]examined the significance of the change of independent directors before and after the company litigation. Gaoetal.[12]studied the change of independent directors before and after the outbreak of financial fraud. Harrisonetal.[13]explained the relationship between corporate litigation, reputation and top executive turnover from the “self-protection theory”.

Whether there is a significant positive correlation between top executive turnover and corporate litigation, foreign scholars have done a lot of empirical researches, while only a few domestic scholars have paid attention to this field. In China’s market economy, is there still a significant correlation between top executive turnover and corporate litigation? What role does political and legal conditions play in this incident? To answer these two questions, we conducted an in-depth empirical research. Our research uses a propensity score matching (PSM) method to avoid sample selectivity bias, and takes all the firms excluding financial firms and firms in special treated (ST) listed on the Shanghai and Shenzhen Stock Exchanges from the years 2009 to 2018 as our empirical research samples. After completing the data processing work, we finally obtained 13 435 samples, and based on this, we obtained relatively robust experimental results. Results of our study enrich the search field of corporate litigation and also be helpful to the construction of society with rule of law in China.

1 Theoretical Analyses and Research Assumptions

1.1 Corporate litigation and top executive turnover

After the corporate litigation occurs, it means that the company will face a certain reputational loss, while a good reputation is very important for the company’s normal operation. Aharonyetal.[10]found that corporate litigation had a positive impact on top executive turnover. We suspect that this correlation may also exist in China’s market economy. We refer to the research of Lüetal.[14], define top executive as the company’s CEO, and study the impact of corporate litigation on top executive turnover. Our hypothesis can be explained from two theoretical logics. (1) Principal-agent theory, the occurrence of corporate litigation means that top executive’s risk management capabilities are poor, and serious reputational consequences can cause shareholders to lose their trust in agents, and finally cause the top executive turnover. (2) Scapegoat theory, corporate litigation will impact the company’s reputation, and top executive turnover can divert public attention, calm down the social storm as soon as possible, and minimize the loss of corporate reputation. According to above analysis, we propose our first hypothesis:

H1: Corporate litigation has a positive impact on top executive turnover.

1.2 Moderating role of political conditions

The political conditions of a company can be discussed from two perspectives: the nature of property right and the political background of top executive. Many scholars consider the nature of property right when discussing corporate governance decisions. The general conclusion is that the nature of property right affects corporate governance decisions. State-owned companies bear social responsibilities such as stabilizing employment, protecting the environment, and supporting national policies[15], which shows that the business objectives of state-owned companies are diversified, not limited to making profits. What’s more, compared to other non-state-owned companies, there are other forms of non-economic benefits such as political promotion for top executive incentives, so state-owned companies usually pay more attention to maintaining reputation than profit targets[16]. The occurrence of corporate litigation will reduce the reputation, and state-owned companies may be more eager to take countermeasures than non-state-owned companies. Based on this, this article believes that the impact of corporate litigation on top executive turnover will be more significant in state-owned companies. Studies by some scholars showed that the political background of top executive has an important effect on corporate governance decisions. Studies by Daietal.[17]showed that the political background of top executive could help companies obtain more political resources, which in turn can help companies quickly calm down incidents and play an effective role in crisis defense. Political resources can help companies, especially private companies, improve financing constraints, earn more subsidies, and obtain tax benefits, and even help companies enter government-controlled monopoly industries[18-20]. Some scholars pointed out that the turnover of top executive of non-state-owned companies could be affected by political connections[21]. Specifically, political connections can curb the firing of top executive. Based on this, the article believes that the political background of top executive will also affect the relationship between corporate litigation and top executive turnover. According to above analysis, we propose our hypotheses as follows.

H2a: When the company is a state-owned company, the impact of corporate litigation on top executive turnover is more significant.

H2b: When the top executive has no political background, the impact of corporate litigation on top executive turnover is more significant.

1.3 Moderating role of legal conditions

The political conditions of a company can also be discussed from two perspectives: the legal environment and the popularity of legal advisers. Companies usually need to sign various contracts in the normal production and operation, and the signing and the execution of the contracts will be affected by the legal environment. Therefore, after the corporate litigation, the differences in legal environment will also affect the company’s reputation differently[9]. In fact, in China, due to uneven regional development, the legal environment between provinces also varies greatly. This can be confirmed from the “Marketization Index of China’s Provinces: NERI Report 2018”[22]issued by the China National Economic Research Institute. In this report, the index of legal environment is used to represent the legal environment of China’s different provinces. According to Yu’s research[23], companies in regions with a high legal environment correspondingly have higher transparency, and shareholders have a clearer understanding of the company’s operating conditions, but when the legal environment is poor, it is difficult for shareholders to judge the size of the risk, which increases the sensitivity of corporate reputation to corporate litigation. Based on this, we can speculate that when the company’s legal environment is poor, corporate reputation is more sensitive to corporate litigation, which may affect the significance of the relationship between corporate litigation and top executive turnover. In addition, some scholars have pointed out that the relationship between corporate litigation and audit quality may be affected by the size of the audit firm[24]. The size and popularity of audit firms often appear in the research on auditing issues, but at present, few domestic scholars have discussed the influence of corporate legal advisers, law firms, on corporate litigation and corporate governance decisions. In fact, corporate litigation is often considered as a sub-optimal solution to conflicts[25], which means that the company’s legal advisers will help the company to avoid corporate litigation as much as possible. The more well-known a legal adviser is, the stronger its business ability is, and the more it can help the company avoid the corporate litigation. At this time, the corporate litigation is still triggered out, which indicates that the situation is more serious, and the probability of top executive turnover is greater. According to the above, we can speculate that the popularity of legal adviser may have a moderating effect on the relationship between corporate litigation and top executive turnover. We propose our hypotheses as follows.

H3a: The worse the legal environment the company is in, the more significant the impact of corporate litigation on top executive turnover is.

H3b: The higher the popularity of the company’s legal advisers is, the more significant the impact of corporate litigation on top executive turnover is.

2 Research Design

2.1 Sample and data description

The research sample of this article is the firms listed on the Shanghai and Shenzhen Stock Exchanges from the years 2009 to 2018. Specifically, our data consists of 4 parts: (1) the basic information of the company and the company’s litigation are from the Wind Database(Wind); (2) the characteristic data of the top executives are from China Stock Market and Accounting Research Database (CSMAR); (3) the marketization index and the index of legal environment are from “Marketization Index of China’s Provinces: NERI Report 2018”[22], and this approach refers to the research of Fu and Ji[9]; (4) the popularity of legal advisers is based on “2019 Chambers Asia-Pacific Guide” which is a comprehensive evaluation guide with high recognition in this field, and law firms with outstanding comprehensive capabilities are regarded as high-popularity firms. After excluding financial and ST companies, dropping the observations without any clear documentation of the offering date and details, 13 435 samples were eventually obtained. There are 2 578 firms which occurr corporate ligation, and they build up the treat group, while the other 10 857 firms build up the control group. Additionally, the key continuous variables are winsorized at the 1stand 99thpercentiles to avoid the influence of outliers.

2.2 Model and variable description

This article refers to the existing scholars’ research[16], considering the characteristics of company, board, corporate governance, and top executive, and builds an empirical measurement model. What’s more, we also noticed that degree of marketization will influence both corporate ligation and top executive turnover, the index of marketization was added into the model. Based on the above analysis[9], we propose the empirical model as

Probability (CEOTurnover)=

f(Law, Control Variables).

(1)

where CEOTurnover is a dummy variable which equals 1 if there is a CEO turnover during the Law is a dummy variable too, as the core explanatory variables of our research, it equals 1 when corporate litigation occurrs during the observation period, otherwise it equals 0. While the specific control variables are selected as follows: performance indicators (ROA), company size (Assets), establishment time (FirmAge), equity concentration (FirHolder), whether the chairman and the CEO are the same person (IsDuality), board size (BODSize), marketization index (MkIndex), top executive age (Age), the length of time that the executive has been in the position (InPlace), and political background (IsFGO). In addition, in order to test the moderating hypothesis of political condition and legal condition, group tests were conducted based on the nature of the company’s property rights, the political background of top executive, the legal environment, and the popularity of legal adviser. The sample variances of the treat group and the control group are shown in Table 1. We also test the mean value of variance inflation factor (VIF) of the variables in our dataset, and the mean VIF equals 1.77, which means that our experiment samples almost exists no significant multicollinearity problems.

Table 1 Summary statistics and sample variances of variables

In Table 1, the summary statistics and the sample variances of variables are presented. ROA is calculated by dividing net profits by total assets. Assets equal the natural logarithm of the company’s assets. FirmAge represents the length of time the company is established. BODSize means the total number of board members. FirHolder equals the shareholding ratio of the largest shareholder. IsDuality is a 0-1 variable. When the chairman and the CEO are the same person, the value is 1; otherwise, the value is 0. MkIndex is the index of marketization, which is come from “Marketization Index of China’s Provinces: NERI Report 2018”[22]. Age means the age of the top executive. InPlace is the length of time the executive has been in the position. IsFGO is a 0-1 variable, and when the top executive has political background, the value is 1; otherwise, the value is 0. Mean is the mean of the variable; p25 is the quarter digit of the sample; p50 is the median of the sample; p75 is three quarters of the number of digits in the sample. ***, ** and * represent significance at 1%, 5% and 10% level, respectively.

2. 3 Explanation of empirical methods

In order to avoid the problem of sample selection bias in empirical research, we refer to the research ideas of Fu and Ji[9], choose the PSM method to conduct our empirical research. The specific implementation process refers to the research of Lianetal.[26]: construct a logit regression model for matching; calculate propensity score (PS) and perform matching; test for parallel hypothesis and common support hypothesis; calculate the average effect of treatment on the treated (ATT), which means the difference of the potential outcomes of the treated group and the control group. The propensity score is the probability of corporate ligation, and it can be expressed by

p(C)=Pr[L=1|C]=E[L|C]

(2)

whereCis the control variables;Lis the indicator variable, which equals 1 if the corporate ligation occurs, otherwise equals 0. Actually,p(C) is the PS score which we use to match control samples with treated samples. And the PS can be calculated by logit model with the following formula:

(3)

whereCiis the detail value of control variables, which can affect the propensity of corporate litigation;αis the vector of coefficients. By the logit model, we can estimate the PS score. After that, we can also estimate the ATT, which can be expressed by

ATT =E[T1i-T0i|Ci=1]=

E{E[T1i|Ci=1,p(Ci)]-

E[T0i|Ci=0,p(Ci)]|Ci=1},

(4)

whereT1imeans the potential outcomes of the treat group, whileT0imeans the potential outcomes of the control group. And we use Stata 14 for all the calculations.

3 Empirical Results

3.1 Sample matching

In our research, Law is the independent variable, while CEOTurnover is the dependent variable. Based on the existing research results, the promiscuous variables that may exist in this study were selected, and logit regression was performed to select the appropriate matching variables. The final matching variables are: ROA, Assets, FirmAge, State, FirHolder, IsDuality, Age, InPlace, IsFGO, and LegAdvisor. This section takes the nearest neighbor matching as an example to show the results of PSM matching. In order to ensure the robustness of the experimental results, the matching ratio is 1∶3. We represent the standardized %bias across covariates in Fig. 1, and we can clearly find out that after the propensity matching, the standardized %bias are controlled within 5%, indicating that the differences of variables between the treated group and the control group is small.

Fig. 1 Standardized bias across covariates

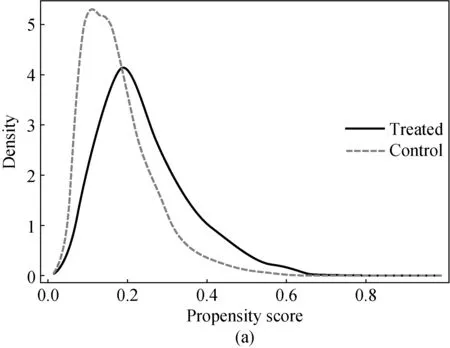

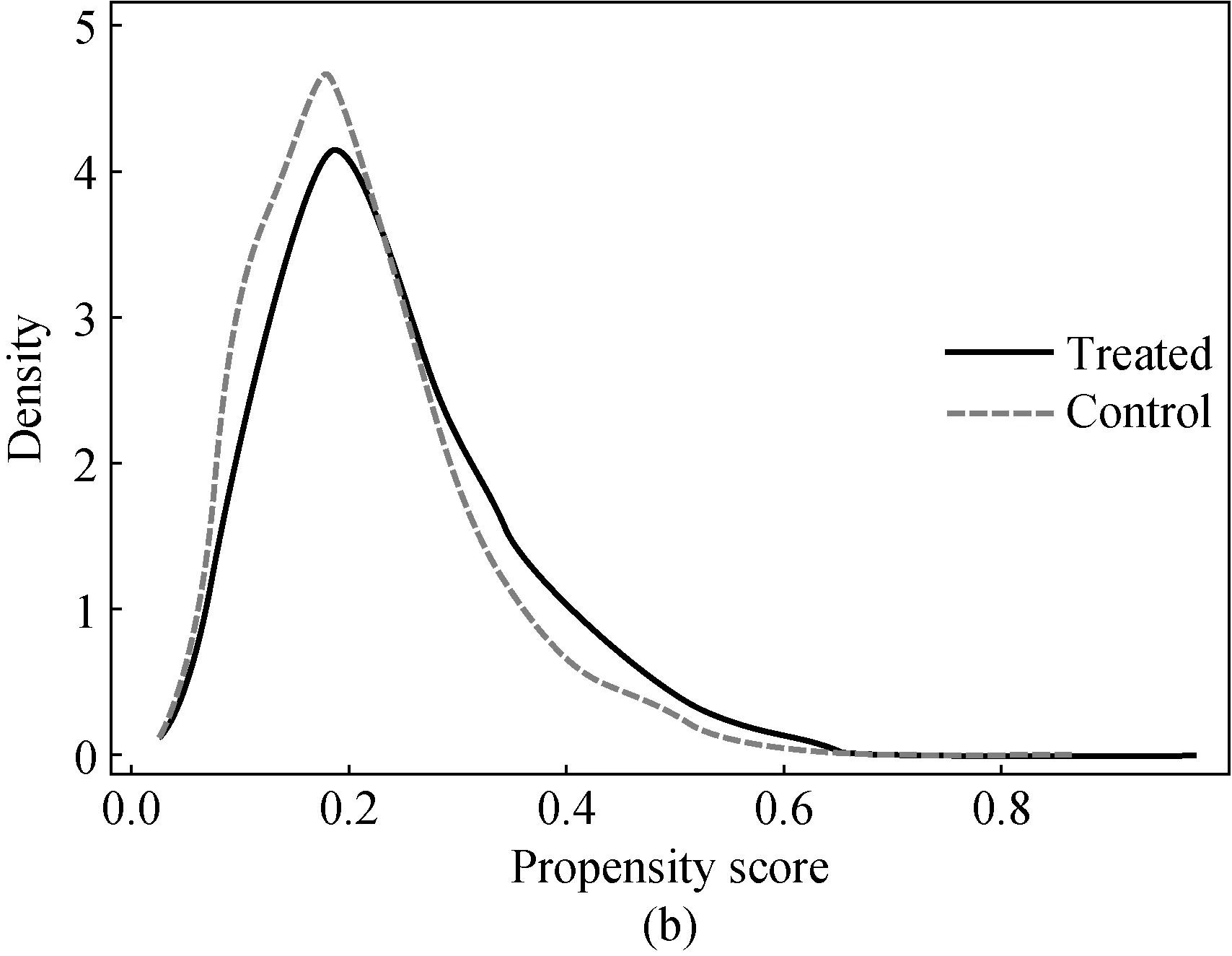

We also give the kernel density functions of the treated group and the control group in Fig. 2. Figure 2(a) represents the unmatched sample, while Fig. 2(b) represents the matched sample. Obviously, the results before and after the PSM matching are significantly different. There was indeed a sample selectivity bias between the treated group and the control group before matching. After the nearest neighbor matching, we can find out that the kernel density functions of the treated group and the control group are more similar than before, as shown in Fig. 2(b), which means the characteristics of control variables in the treated group and the control group are parallel.

In order to get a more robust conclusion, we use the nearest neighbor matching, the radius matching and the kernel matching to match the control group with the treated group, respectively. They all passed the parallel hypothesis and common support hypothesis.

Fig. 2 Kernel density of treated groups and control groups for:(a) the unmatched sample; (b) the matched sample

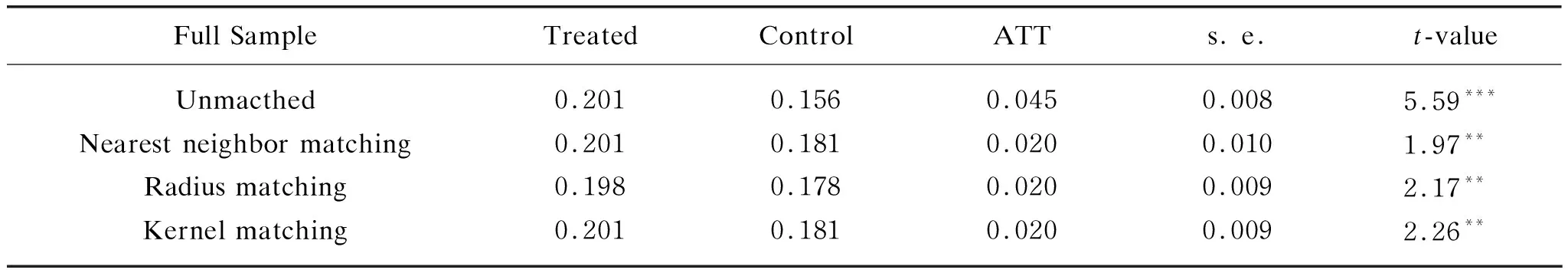

3.2 Results on basic relationship hypothesis

Our research examined the basic relationship between corporate litigation and top executive turnover. As we have mentioned before, we use three methods to estimate ATTs. The results are shown in Table 2. Observing the data in Table 2, it can be found that after controlling the interference of the confounding variables, corporate litigation and top executive turnover are positively correlated at a significance level of 5%, and all three matching methods can support this conclusion. This shows that the hypothesis H1 of this paper is true, that is, after excluding the influence of confounding variables, there is indeed a significant positive correlation between corporate litigation and top executive turnover.

Table 2 Significant relationship between corporate litigation and executive change

Note: 1. Unmatched refers to the sample without matching. 2. Treated refers to the sample where corporate litigation happens. 3. Control refers to the sample where corporate litigation does not happen. 4. “s.e.” refers to the standard errors, which are calculated using bootstrap with 500 replications. 5. The test method for the significant difference between the means isttest, and ***, **, and * indicate that they are significant at the levels of 1%, 5%, and 10%, respectively.

3.3 Results on moderating roles hypotheses

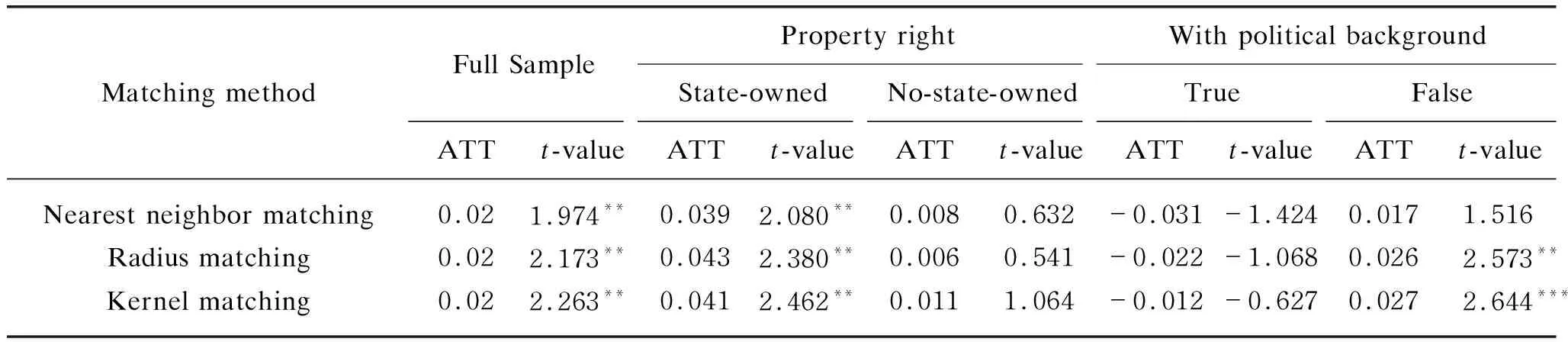

In this paper, we group different political condition and legal condition samples to verify moderating roles hypotheses. Three matching methods were used in our empirical test, which are nearest neighbor matching, radius matching, kernel matching.

The test results of political conditions are shown in Table 3. The data in Table 3 show that when the company is a state-owned company, the positive correlation between corporate litigation and top executive turnover is significant, while as to non-state-owned companies it is not. This indicates that the assumption of H2a is true, that is, when the company is a state-owned company, the impact of corporate litigation on the top executive turnover is more significant. When the top executive has a political background, the relationship between corporate litigation and top executive turnover is not significant, while when the top executive does not have a political background, the two have a significant positive correlation when the matching methods are radius matching and kernel matching. These results can basically indicate the establishment of the hypothesis of H2b in this article, that is, when top executive does not have political background, the impact of corporate litigation on top executive turnover is more significant.

Table 3 Moderating roles of political conditions

Note: 1. State-owned refers to the sample of state-owned firms, and no-state-owned refers to the sample of no-state-owned firms. 2. True refers to the sample in which top executives have political background, and False refers to the sample in which top executives have no political background. 3. The test method for the significant difference between the means isttest, and ***, ** and * indicate that they are significant at the levels of 1%, 5%, and 10%, respectively.

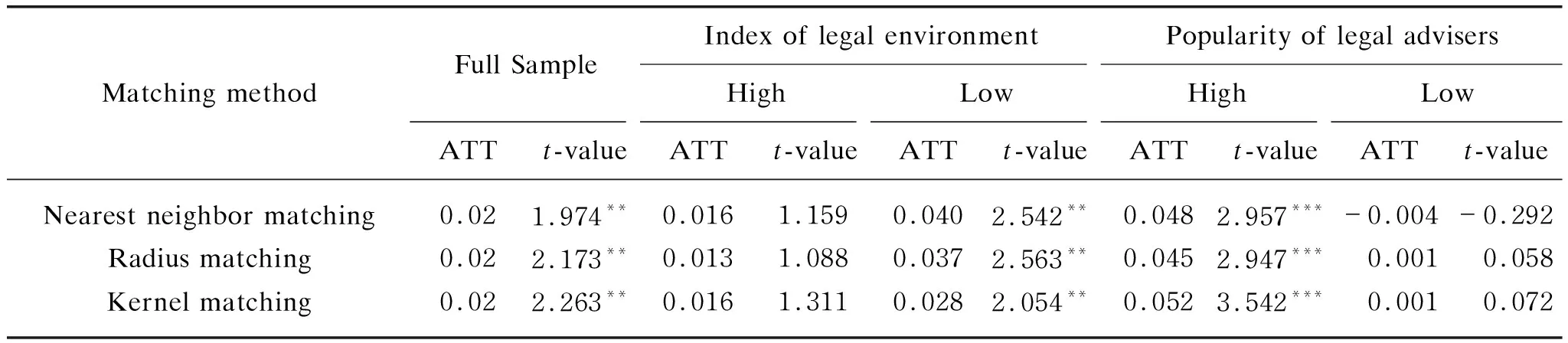

The test results of legal conditions are shown in Table 4. The data in Table 4 show that when the legal environment is good, the relationship between executive changes and corporate litigation is not significant, and when the legal environment is poor, there is a positive correlation at a significance level of 5%. This shows that the hypothesis of H3a is true, that is, the worse the company’s legal environment is, the more significant the impact of corporate litigation on top executive turnover is. When the company’s legal adviser is well-known, the significant level of positive correlation between top executive turnover and corporate litigation reaches 1%, and this correlation is no longer significant when the legal adviser’s popularity is low. This indicates that the hypothesis of H3b is valid, that is, the higher the company’s legal adviser popularity is, the greater the impact of corporate litigation on top executive turnover is.

Table 4 Moderating roles of legal conditions

Note: 1. High Index of legal environment means that the legal environment of the company is good, while low means poor. 2. High Popularity of legal advisers means that the company’s legal adviser is famous, while low means normal. 3. The test method for the significant difference between the means isttest, and ***, **, and * indicate that they are significant at the levels of 1%, 5%, and 10%, respectively.

4 Conclusions

This article uses data of companies listed on the Shanghai and Shenzhen Stock Exchanges from the years 2009 to 2018. After PSM matching, suitable control group samples were found for each experimental group sample. In this way we can get a more reliable conclusion: there is indeed a significant positive correlation between corporate litigation and top executive turnover. We also find out that the political condition and legal condition can play moderating roles in the relationship from different perspectives, and details are as follows: top executive turnover of state-owned companies will be more sensitive to corporate litigation events; when top executive has political background, the occurrence of changes in executives caused by company litigation events can be effectively resisted; the worse the legal environment is, the more significant the relationship between company litigation and top executive turnover is; when the company’s legal adviser has a higher popularity, the positive correlation between company litigation and top executive turnover is more significant.

Our research reflects the following four issues. (1) State-owned companies do pay more attention to reputation issues, but executives with political background can still resist the risk of firing. (2) Top executive turnover in regions where the legal environment is poor are also more sensitive to corporate litigation. To better solve the problem of imbalanced regional economic development, we need to strengthen the construction of the socialist rule of law. (3) With the rapid development of society and economy, it is very important for top executives to improve litigation risk management capabilities. (4) After the company litigation, was the “bearer” introduced by the company really the responsible person? Has the company substantially corrected the violation or just pass the buck to the departing CEO? It remains to be investigated. When encountering similar situations, the supervisory authority should clearly blame the subject and fundamentally punish illegal acts. The research results of this article have certain guiding significance for strengthening the construction of a rule of law society and the supervision of the manager’s market.

杂志排行

Journal of Donghua University(English Edition)的其它文章

- Acoustic Performance of Green Composites for Chinese Traditional Percussion Drums

- Fabrication and Characterization of Polypyrrole/Polyurethane/Polyamide/Polyamide Yarn-Based Strain Sensor

- Friction and Wear Behaviors of C/C-SiC Composites under Water Lubricated Conditions

- Performance Analysis of Cushioned Sport Soles with Plantar Pressure Test

- Existence Criterion of Three-Dimensional Regular Copper-1, 3, 5-Phenyltricarboxylate (Cu-BTC) Microparticles

- Combining User-Driven Social Marketing with System-Driven Personalized Recommendation for Student Finding