Status quo of China’s textile machinery industry from January to June 2019

2019-12-04

In the first half of 2019, in the face of complex domestic and international macroeconomic conditions, affected by the comprehensive factors such as increased pressure on the textile market and cyclical adjustment of the industry, the main economic indicators of the textile machinery industry fluctuated and the export market increased slightly. The operation is under pressure but the overall operation is in line with expectations. The industry closely focuses on structural adjustment and industrial upgrading, actively explores the international and domestic markets, focuses on intelligent manufacturing, and promotes the process of high-quality development of the industry.

Basic information on the textile machinery industry

Revenue

From January to June 2019, the total assets of 680 textile machinery enterprises above designated size were 102.501 billion yuan, an increase of 8.56% compared with the same period of last year. The operating income was 45.971 billion yuan, a decrease of 0.79% compared with the same period. The growth rate was 9.61 percentage points lower than that of the whole year of 2018. It started well in the first quarter and achieved a growth rate of 14.57%. The growth rate of the industrys operating revenue has declined year-on-year since April, with the largest decline of 26.28% in April, 5.48% in May, and 4.41% in June, narrowing month by month.

Profitability

From January to June 2019, the total profit of textile machinery enterprises above designated size was 3.205 billion yuan, an increase of 0.46% compared with the same period of last year. The operating profit margin was 6.97%, an increase of 0.09 percentage points over the same period of last year. The loss of loss-making enterprises was 227 million yuan, an increase of 1.18% compared with the same period of last year; the percentage of loss-making enterprises was 18.97%, an increase of 3.65 percentage points over the same period of last year.

Cost and expenses

From January to June 2019, the total cost of textile machinery enterprises above designated size was 42.325 billion yuan, a decrease of 0.98% compared with the same period of last year, and the growth rate decreased by 3.19 percentage points compared with the same period of last year. The operating cost was 38.126 billion yuan, a decrease of 0.80% compared with the same period of last year, accounting for 90.07% of the total cost; the industrys three expenses ratio was 9.13%, a decrease of 0.94 percentage points compared with the same period of last year, of which the selling expenses was 1.442 billion yuan, a decrease of 5.57% compared with the same period of last year, accounting for 3.41% of the total cost; administrative expenses was 2.381 billion yuan, a decrease of 0.31% compared with the same period of last year, accounting for 5.63% of the total cost; financial expenses was 376 million yuan, a decrease of 4.15% compared with the same period of last year, accounting for 0.99% of the total cost. By improving management levels and reducing costs and increasing efficiency, enterprises have maintained relatively stable profits in the case of a slight decline in operating income.

Import and export of textile machinery industry

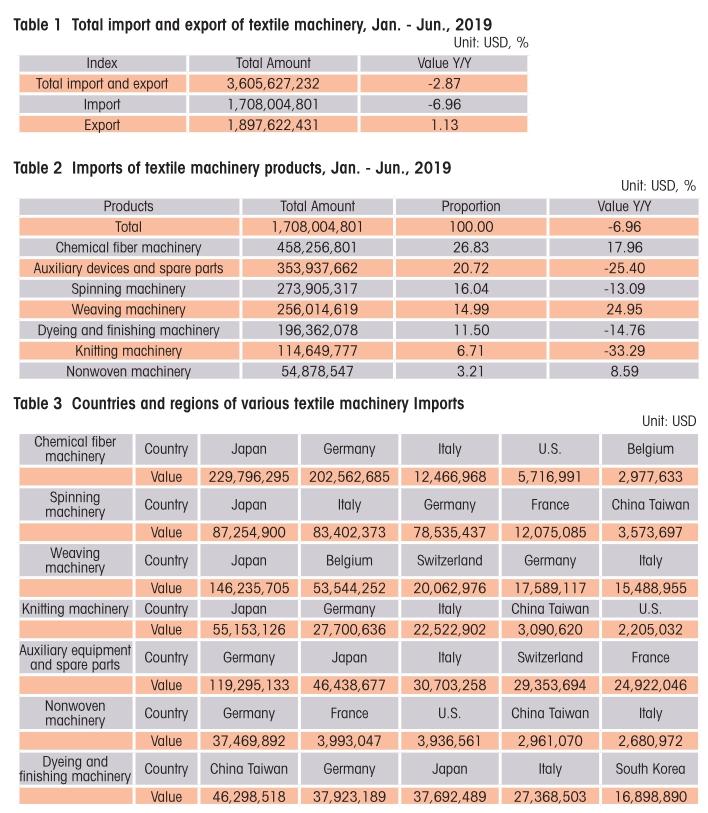

According to customs statistics, the total import and export of textile machinery in China from January to June 2019 was USD 3.606 billion, down 2.87% compared with the same period of last year. Among them: the import of textile machinery reached USD 1.708 billion, compared with the same period last year, a decrease of 6.96% year-on-year; the export reached USD 1.898 billion, an increase of 1.13% compared with the same period last year. The export growth rate is greater than the import growth rate, and the trade surplus has been achieved for five consecutive months since this year. The table below reflects the import and export of textile machinery in China.(Table 1)

Overview of textile machinery products import

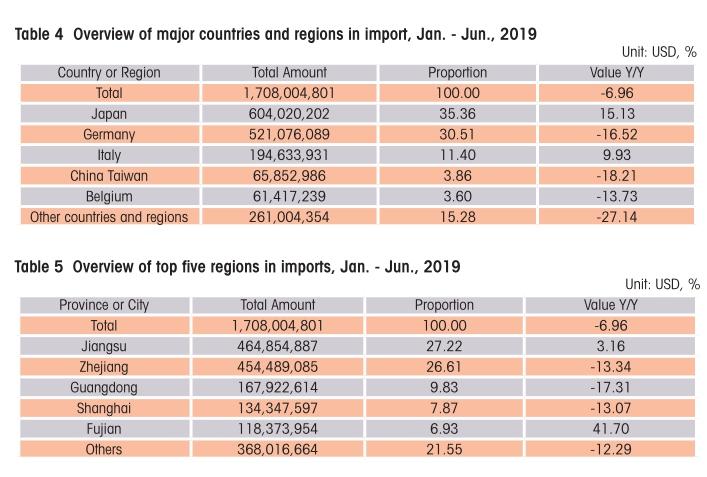

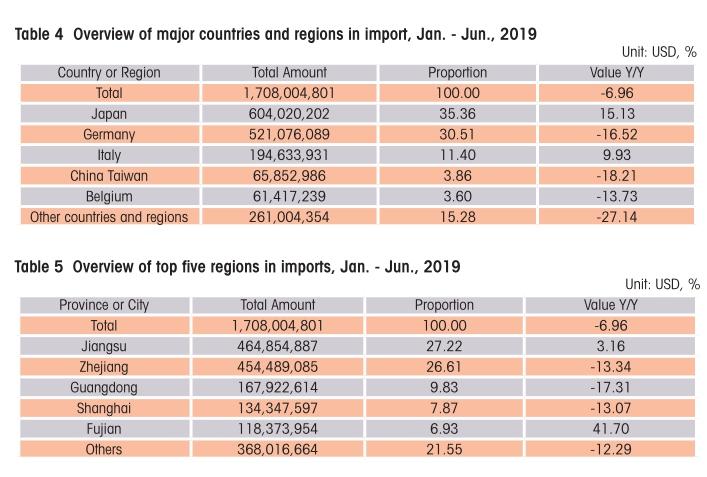

From January to June 2019, textile machinery was imported from 63 countries and regions, with a total import value of USD 1.708 billion, a year-onyear decrease of 6.96%.

★Imports of textile machinery products

From the perspective of imported product categories, chemical fiber machinery imports ranked first, with a total import value of USD 458 million, an increase of 17.96% compared with the same period of last year, accounting for 26.83% of total imports; in addition to chemical fiber machinery, weaving machinery and nonwoven machinery, the seven categories of products have been reduced by different degrees. Driven by downstream demand, chemical fiber machinery surpassed auxiliary equipment and spare parts in the first place of import since the end of 2018, maintaining the growth trend of imports in the first half of the year. With the industrial transfer and upgrading, and the growth of downstream demand, weaving machinery maintained a high import growth rate, but the increase declined. (Table 2 & 3)

★Main countries and regions of textile machinery imports

From January to June 2019, Japan, Germany, Italy, China Taiwan and Belgium are the main countries and regions of textile machinery imports, with the top five import trade volume of USD 1.447 billion, down 2.07% compared with the same period last year, accounting for 84.72% of the total import volume. The domestic market demand for weaving machinery has supported the growth of Japans import volume.(Table 4)

★Textile machinery export areas

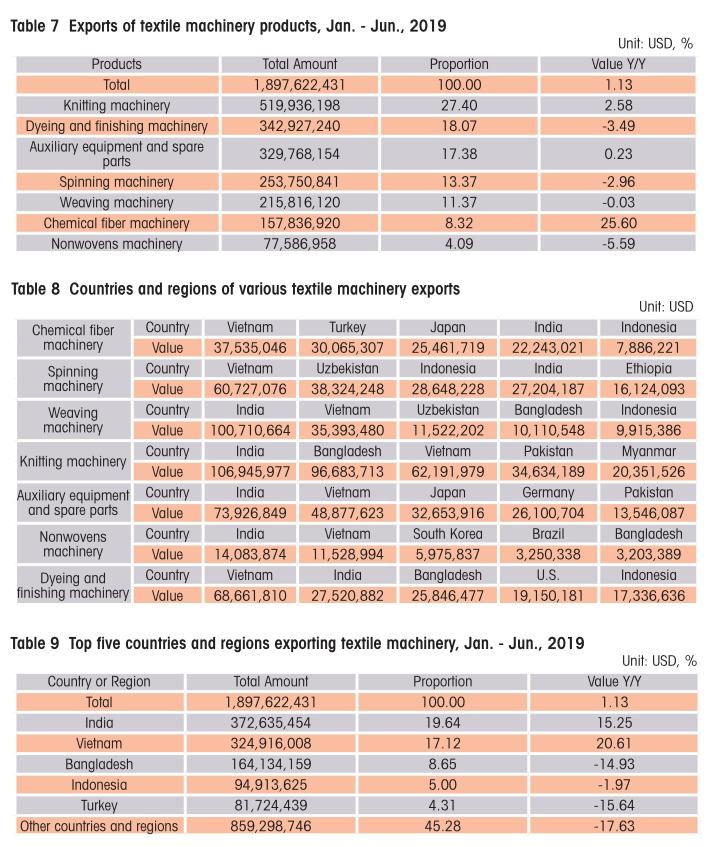

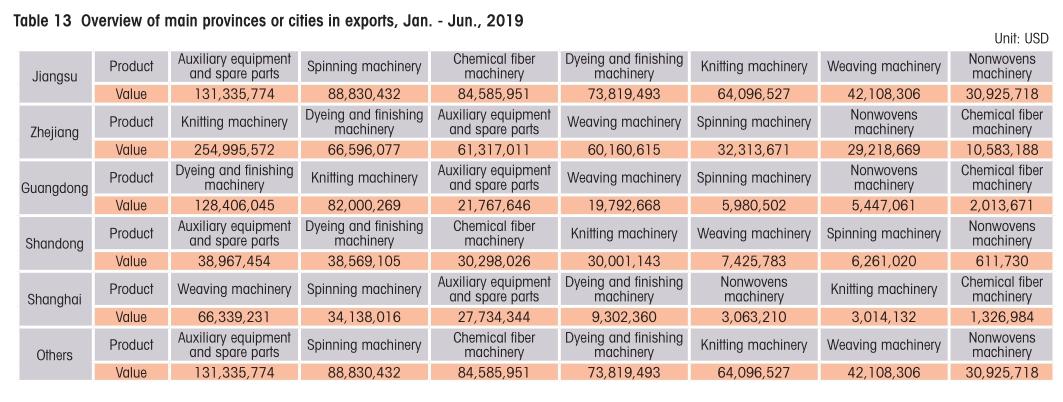

From January to June 2019, a total of 30 provinces, municipalities and autonomous regions exported textile machinery products. The top five provinces and municipalities accounted for 83.97% of the total exports, as shown in the table below. (Table 12 & 13)

★Exports to the United States

Since August 2017, the United States Trade Representative initiated the investigation under section 301 into China. From May 10, 2019, the tariff rate on the USD 200 billion listed goods imported from China has been increased to 25%. Chinas textile industry exports to the United States, including almost all kinds of textile yarns, fabrics, knitting, industrial finished products and some home textiles and textile machinery products, which export more than USD 4 billion a year to the United States. Since then, the United States has announced that it intends to increase tariffs on Chinas USD 300 billion tariffs, including clothing with a large proportion of Chinas textile industrys exports to the United States, most of its home textiles and parts of textile machinery products, involving exports to the U.S. for more than USD 40 billion.

The products for which tariff has been imposed on textile machinery mainly involve most of the chemical fiber machinery, dyeing and finishing machinery, and the list of tax increases of USD 300 billion mainly involves most of the spinning machinery, knitting machinery, auxiliary device and spare parts and some weaving machinery. At present, Sino-US trade relations have not eased, in the first half of this year, Chinas textile machinery industry exported USD 43 million to the United States, accounting for 2.28% of all textile machinery exports, down 21.07% year-on-year. The United States is the ninth largest exporter of textile machinery products in China. In the first half of the year, the export of spinning machinery, weaving machinery, auxiliary devices and spare parts, dyeing and finishing machinery decreased significantly. The United States has a small share in Chinas textile machinery export market, and the reduction of exports to the United States has a limited impact on the export of the entire textile machinery industry.

Industry outlook

At present, the domestic and international economic situation is still complicated and severe, the global economic growth is weak, and the international trade boom is declining. External instability and uncertainties have increased.The Sino-US trade situation is uncertain, and Chinas macroeconomic operating pressure has increased. Affected by the slowdown in international market demand and uncertain trading environment, the textile export situation in the second half of the year is not optimistic. The potential of domestic demand is to be further explored, and corporate investment will be more cautious. In 2019, the market pressure faced by the textile machinery industry increased, production and sales gradually slowed down. After the high growth rate in 2017 and 2018, the overall operation of the textile machinery industry will enter the adjustment stage.