A note on measuring the non-linear dependence via sub-copula based regression

2018-01-23WEIZhengZHANGRui

WEI Zheng, ZHANG Rui

(1.Department of Mathematics and Statistics, University of Maine, Orono, ME,04469-5752,USA;2.School of Mathematics,Northwest University, Xi′an 710127, China)

1 Introduction

Dependence or association modeling between two random variables plays an important role in statistics literature.Measuring the strength of various association has an extensive body of literature.The most prominent and popular measures of associations between random variables include but not limited to Pearsons correlation coefficient[1],Spearmansρ[2]and Kendallsτ[3].

However,these measures are not suitable if the data shows the non-linear relationship between the variables.This is because Pearsons correlation coefficientronly measures the linear relationship of random variables, Spearmansρand Kendallsτare measures of monotonic relationships. As a motivation, we provide a simple example below.

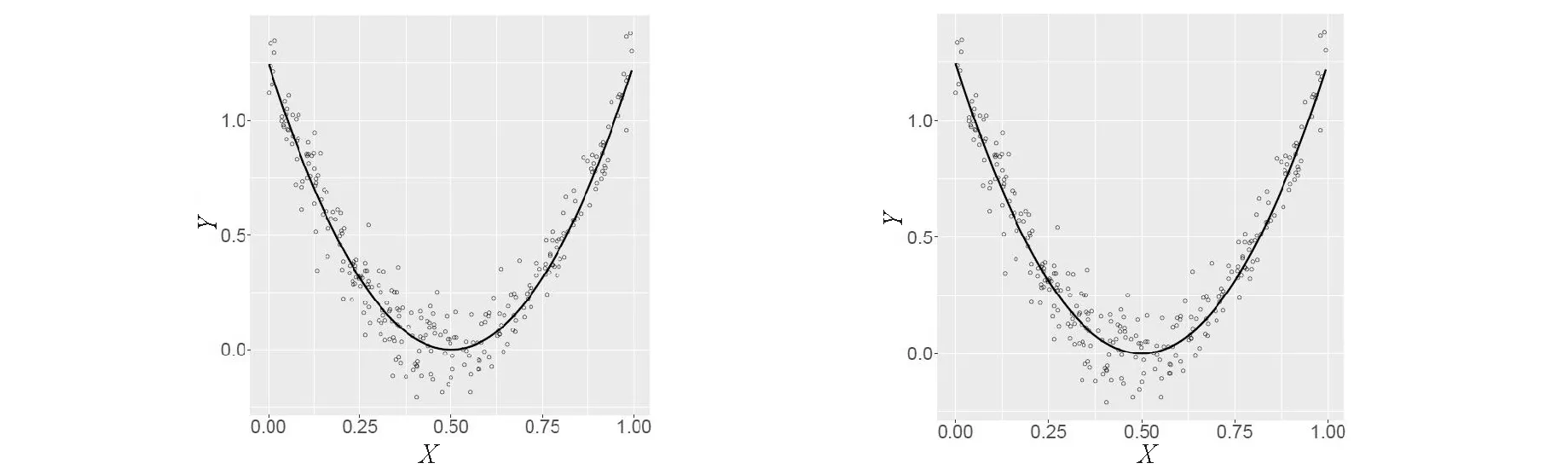

Example1AssumeXi,Yi,i=1,…,n, are identical and independent distributed(i.i.d.) random variables withYi=5(Xi-0.5)2+σ∈i,Xifollows uniform distribution on [0,1], and ∈i,i=1,…,nare i.i.d. standard normal random variables. Thus, the true model considered here is that the random variableYis a non-linear(quadratic) function ofX(not vice versa). We simulate the data forn=300, 1 000 and provide the scatter plots in Fig.1.

Fig.1 Scatterplots of bivariate data generated from the true model Yi=5(Xi-0.5)2 (solid line) with respect to the sample size n=300 (left), and 1 000 (right)

The plots in Fig.1 indicate strong nonlinear relationship between the variables, however,the Pearson′s correlation coefficientr=0.021,Spearmansρ=-0.008, and Kendallsτ=-0.004 forn=300 andr=-0.02,ρ=-0.003, andτ=-0.009 forn=1 000 are all very small (close to zero).

Example 1 shows that it is in contrast to the common belief that linear relationship is more revealing about the underlying random variables than nonlinear relationship. We expect that these problems would be even more severe and more difficult to detect for high dimensional predictors.

In statistical association analysis, it is often assumed the relevant random variable follows some parametric distribution families. The parametric approach often suffers from possible shortcomings induced by the misspecification of the parametric family. Additionally, even for the same type of association and same marginal distribution the associated joint distributions could be very different.

Therefore, a natural questions is how we can determine or quantify the general association(linear or nonlinear) between random variablesXandYby utilizing a non-parametric approach. In this article, we review a new asymmetric dependence measure based on subcopula based regression which was proposed by Wei and Kim[4]and focus on the association analysis between continuous random variables considering toth interaction directionality and nonlinearity. The rest of the article is structured as follows. Section 2 briefly reviews the definition of the subcopula and the asymmetric dependence measure for contingency based on subcopula based regression proposed in[4](Wei and Kim,2017). Then, section 3 examines the use of the measure for nonlinear association for data generated from continuous random variables. We end this article by a conclusion section.

2 Review on subcopula and Subcopula-based measure of asymmetric association for contingency tables

In this section, we briefly reviews the definition of subcopulas and the asymmetric dependence measure for contingency based on subcopula based regression which was proposed in[4](Wei and Kim, 2017).

2.1 Review on subcopula

Copula is a technique to introduce and investigate the dependence between variables of interests.Copulas are frequently applied in many application areas including fiance[5-8],insurance[9](Jaworski et al.,2010),risk management[10](Embrechts et al.,2002),health[11](Eluru et al.,2010) and environmental sciences[12](Zhang and Singh,2007).Here,we briefly review the definition of the bivariate subcopula and copula function.For more details about the copula and dependence concepts in terms of subcopulas and copulas,see[13-17](Joe,2014;Nelsen,2006;Wei et al.,2015;Wei and Kim,2017).

Definition1[14](Nelsen,2006) A bivariate subcopula (or 2-subcopula) is a functionCS:D1×D2|→[0,1], whereD1andD2are subsets of [0,1] containing 0 and 1, satisfying following properties:

(a)CSis grounded,i.e.,CS(u,0)=CS(0,ν)=0;

(b) For everyu,ν∈[0,1],CS(1,ν)=νandCS(u,1)=u;

(c)CSis 2-increasing in the sense that, for anyu1≤u2,ν1≤ν2withui,νi∈[0,1],i=1,2,

volCS(J)=CS(u2,ν2)-CS(u2,ν1)-CS(u1,ν2)+CS(u1,ν1)≥0,

A bivariate copula (or 2-copula)C(u,ν) is a subcopula withD1=D2=[0,1].

From the Definition 1 a subcopula(copula) is a (unconditional) cumulative distribution function (CDF) onD1×D2([0,1]).The condition (b) indicates a 2-copulaCis a bivariate CDF with uniform margins. LetXandYbe two random variables (discrete or continuous) with the joint CDFH(x,y) and marginal CDFF(x) andG(x).There exists a subcopula functionCSsuch thatH(x,y)=CS(F(x),G(y)) by the Sklars theorem[18](Sklar,1959).Furthermore, ifXandYare both continuous random variables, then there exist a unique copulaCsuch thatH(x,y)=C(F(x),G(y)).

2.2 Subcopula-based measure of asymmetric association for contingency tables

(1)

The marginal p.m.f.s and the joint p.m.f ofCsassociated with the table are,respectively,p0(ui)=pi·,p1(νj)=p·j,cs(ui,vi)=pij. Furthermore, the conditional p.m.f.s and the conditional p.m.f.are, respectively,

(2)

Then,one can quantitatively measure the asymmetric dependence between the two variablexXandYin anI×Jcontingency table.

Definition2(Wei and Kim,2017)[4]Given anI×Jcontingency table, a measure of subcopula-based asymmetric association of column variableYon row variableXand of row variableXon column variableYare defined as follows, respectively:

and

(3)

3 One example for continuous random variables

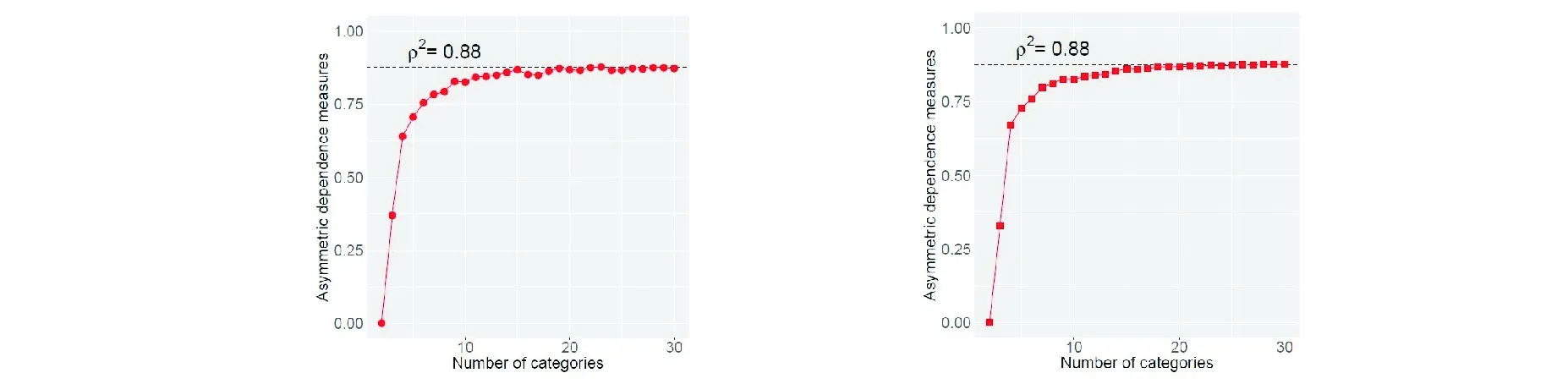

The asymmetric association measureρ2in Definition 2 measures the association for the discrete random variable associated with the two-way contingency table without parametric assumptions on the joint distributions.In this section,we develop one procedure to apply the subcopula-based asymmetric association measure on continuous random variables and illustrate the procedure along with the Example 1 as follows.

First,in order to apply asymmetric association measureρ2in Definition 2 on the continuous random variables, data must be quantized into categorical data.We can construct theI×Icontingency table by classifying thendata points intoIcategories for each variable. For example,if we setI=5 for data (n=300 andn=1 000) simulated from Example 1.1, we have the following two contingency tables, Table 3.1a and 3.1a.Note that for this example, we can classify each variable withIequal-width categories,i.e.,[a,a+(b-a)/I,[a+(b-a)/I,a+2(b-a)/I),…,[a+(I-1)(b-a)/I,b], whereb=max{x1,…,xn} forX(b=max{y1,…,yn} forY),a=min{x1,…,xn} forX(a=min{y1,…,yn} forY).

Tab.1 Two-way contingency tables constructed based on categorical data withI=5 quantized from the continuous data in Example 1.1

XYI1I2I3I4I5I10123237I27471200I3753600I4753600I500202210

(a)n=300

(b)n=1 000

4 Conclusion

In this paper,we have reviewed a subcopula-based measure of the asymmetric association for a two-way contingency table, which was proposed in (Wei and Kim, 2017)[4]. We applied the proposed measure to a data set with the non-linear relationship and showed it can be used as a tool to detect the non-linear association. The proposed procedure is illustrated via a simulation example.

Fig.2 The subcopula based asymmetric association measure with respect to the number of the categories with respect to the sample size n=300 (left), and 1 000 (right)

[1] PEARSON K. Note on regression and inheritance in the case of two parents[J].Proceedings of the Royal Society of London, 1895, 58:240-242.

[2] SPEARMAN C.The proof and measurement of association between two things[J].The American Journal of Psychology, 1904,15(1):72-101.

[3] KENDALL M G.A new measure of rank correlation[J].Biometrika,1938,30(1/2):81-93.

[4] WEI Z, KIM D.Subcopula-based Measure of Asymmetric Association for Contingency Tables[J].Statistics in Medicine,2017,36(24):3875-3894.

[5] PATTON A J. Modelling asymmetric exchange rate dependence[J].International Economic Review, 2006,47(2):527-556.

[6] 张尧庭. 连接函数(copula) 技术与金融风险分析[J].统计研究, 2002, 4: 48-51.

[7] 吴振翔,叶五一,缪柏其.基于Copula的外汇投资组合风险分析[J].中国管理科学学报,2004( 4) :1-5.

[8] 龚金国,史代敏,时变Copula模型的非参数推断[J].数量经济技术经济研究,2011(7):137-150.

[9] JAWORSKI P, DURANTE F, HARDLE W K, et al.Copula Theory and Its Applications[M].Berlin, Heidelberg: Springer, 2010.

[10] EMBRECHTS P, MCNEIL A, STRAUMANN D.Correlation and Dependence in Risk Management:Properties and Pitfalls[M].Risk Management:Value at Risk and Beyond,2002:176-223.

[11] ELURU N, PALETI R, PENDYALA, R, et al.Modeling injury severity or multiple occupants of vehicles:Copulabased multivariate approach[J].Transportation Research Record:Journal of the Transportation Research Board,2010(2165):1-11.

[12] ZHANG L, SINGH V P.Bivariate rainfall frequency distributions using archimedean copulas[J].Journal of Hydrology,2007,332(1):93-109.

[13] JONE H. Dependence Modeling with Copulas[M].London:Chapman & Hall, 2014.

[14] NELSEN R B.An Introduction to Copulas(second edition)[M].New York:Springer, 2006.

[15] WEI Z, WANG T, NGUYEN P A.Multivariate dependence concepts through copulas[J].International Journal of Approximate Reasoning, 2015,65:24-33.

[16] 龚金国,史代敏,时变Copula模型非参数估计的大样本性质[J].浙江大学学报(理学版),2012 (6): 630-634.

[17] 龚金国,邓入侨,时变C-Vine Copula模型的统计推断——基于广义自回归得分理论[J].统计研究,2015(4):97-103.

[18] SKLAR M. Fonctions de répartitionndimensions et leurs marges[J].Publications de l′Institut de Statistique de L′Université de Paris,1959,8:229-231.