Research on the Influence Degree and Effect of Support on Innovation Incentives for R&D Personnel in Micro and Small Enterprises: An Empirical Study based on the China Micro and Small Enterprise Survey (CMES)

2022-11-12XiongYangLiHaojunandTangJiqiang

Xiong Yang, Li Haojun and Tang Jiqiang

Southwestern University of Finance and Economics

Abstract: In this study, the influence degree and effect of support on innovation incentives for research and development (R&D) personnel in micro and small enterprises (MSEs) were explored based on the CMES data. We found that government support will increase the R&D wage and widen the gap between R&D wage and staff wage, especially for small, non-hightech enterprises with strict financing constraints. Furthermore, taking the wage gap as a mediator, we concluded that support would widen the wage gap and increase management innovation rather than technological innovation in MSEs because the wage premium of R&D personnel is the main driver for the increase of management innovation. The findings of this study provide useful enlightenment for China to implement an innovation-driven strategy and build an innovative country.

Keywords: micro and small enterprises (MSEs), support, innovation, wage gap

Introduction

The world is undergoing accelerating changes unseen in a century. The treacherous global economic situation aggravates instability and uncertainty, and the drivers brought about by the last round of the industrial revolution are gradually fading. It is thus imperative for us to foster new drivers and stimulate endogenous growth. Innovation is a key link in driving sustainable economic growth, as well as a strategic underpinning for high-quality development and a new journey of building a modern socialist country. According to the CPC Central Committee's proposals for formulating the 14th Five-Year Plan (2021-2025) for National Economic and Social Development and the Long-Range Objectives Through the Year 2035, which was adopted at the Fifth Plenary Session of the 19th Central Committee of the Communist Party of China, China has a large number of MSEs,which are an important driver in China’s socioeconomic development. As the development of MSEs is inseparable from the drivers of innovation, the further promotion of innovative development can highlight the competitive edge of micro-enterprises, serve as an important driver for the sustainable growth of the macro-economy, and further respond to crises caused by the external environment such as COVID-19 (Schumpeter, 1934; Krugman, 1979; Lin, 2002; Yang, 2020). Under the new normal of the present, sluggish economy, China’s traditional competitive edge continues to weaken as its economic growth has been driven by innovation instead of expanding growth factors and investments. Thus, technological innovation, which can raise productivity, enhance product quality,and promote technological progress, has become the core engine of China’s economic development (Li& Zheng, 2016; Kong et al., 2017; He & Zhang, 2018). Because of the high risk, long cycle, externality,and spillover effects of technological innovation (Arrow, 1962), the Chinese government has launched various supportive policies, among which fiscal innovation support are one of the most important supportive policies. According to the reports on the final accounts of the Ministry of Finance of the People’s Republic of China, from 2012 to 2021, the national public budget expenditure on science and technology reached RMB7.1 trillion, an average yearly increase of over 7 percent; in 2020, the national financial expenditure on science and technology reached RMB1,009.5 billion. Therefore,whether the innovation support policy can improve the quality and efficiency of technological innovations, promote industrial transformations and upgrading, and achieve notable economic results is crucial to the sustainable, healthy development of China’s economy.

As a part of “the initiative of mass entrepreneurship and innovation,” MSEs are an indispensable force for China’s socioeconomic development, but at the same time, many of the MSEs face serious challenges, including weak financial strength and low market influence (Huang, 2018). In particular, the outbreak of COVID-19 has caused a huge negative impact on socioeconomic development, and a large number of small and medium-sized enterprises (SMEs) have been left with operating difficulties (Li et al., 2020). Financial support for MSEs is a common tool used by governments worldwide (Robinson,1969), which is mainly achieved by upgrading the technological level of enterprises for higher productivity (Yuan & Zhu, 2020). For example, the United States heavily invests financial support for small business start-ups, research and development, and commercialization (Li & Wang, 2022);South Korea adopts a risk-sharing government support on corporate R&D investment (Lee & Cin,2010); France, Germany, Italy, Spain and the UK focus on supporting R&D patents (Stefan et al., 2018).China has also launched relevant fiscal support policies to encourage innovation in MSMEs. Studies have found that fiscal support can compensate for some innovation externality risks of firms (Zhu et al., 2010) and significantly increase the innovation investment of MSMEs (Huang, 2018). Support will help alleviate the innovative pressures on MSEs. With more disposable capital, the enterprises will be more capable of business expansions and increased investments in innovation while resisting risks. Therefore, it is of great practical and policy significance to investigate the implementation effect of fiscal support policy from the micro perspective of MSEs innovation, to give full play to support for guiding enterprise innovations, to promote industrial optimization and upgrading, to adopt an innovation-driven strategy and to build an innovative country.

At present, the research on China’s fiscal support policy mainly comes from two perspectives.The first perspective is to analyze the selectivity and objective of support policies, and it is found that government support tend to favor state-owned enterprises, public services, and high-tech enterprises (Shao & Bao, 2011; Bu & Yu, 2012; Kong et al., 2013), because these enterprises facilitate the government in achieving its social goals (Tang & Luo, 2007). However, a small number of support are presently motivated by the earnings of listed companies (Tang & Luo,2007; Chen et al., 2008). The second perspective is to focus on the implementation effects of a support policy and explore whether the support policy has an incentive effect or an inhibitory effect. Liu (2016) argued that there is a significant positive correlation between fiscal support and corporate investments, but support, in turn, restrict corporate financing and research investments to some extent. Yang et al. (2015), from the perspective of ownership and production elements market distortions, found that government support have a positive effect on the innovation performance of private enterprises. Zhang et al. (2015), on the other hand, believed that innovation support, especially gratuitous support, have no significant effect on the R&D of SMEs. According to Huang et al. (2018), support increase innovation investments in MSEs, but rent-seeking makes the positive incentive effect smaller than that of tax incentives. According to Chen et al. (2022),innovation incentives generated by government support for small enterprises are significantly stronger than those for large enterprises. Clearly, most of the literature focuses on the effects of support on R&D input, investments, and financing, while relatively little attention is paid to the effects of labor. The existing limited studies analyze the effect of support on executives’ wages based on the managerial power hypothesis (Luo et al., 2014; Bu et al., 2014; Tong, 2017). In the era of a knowledge economy, human capital is the core capital of a country and an enterprise,and technological innovation is inseparable from human capital (Yang & Li, 2004), and R&D personnel are the carrier of human capital and the main body of technological innovation in enterprises. The findings of An & Pi (2019) show that the best support scheme is to raise the price of dedicated human capital for original innovation. Nevertheless, listed companies do not disclose the remuneration of R&D personnel, causing little literature available to analyze government innovation support from the perspective of R&D personnel’s innovation incentives.

As a result, we used the China Micro and Small Enterprise Survey(CMES) data to examine the influence degree and effect of support on innovation incentives of R&D personnel in MSEs.Existing research indicates that innovation support for MSEs will widen the wage gap between researchers and staff. This expanding wage gap is reflected in the fact that the average R&D wage increases while the average staff wage remains unchanged. This effect is more prominent in small, non-high-tech enterprises with strict financing constraints. Additionally, support cause an increase in managerial innovation in MSEs by widening the gap between R&D wage and staff wage, and this increase mainly comes from the wage premium of R&D personnel. However, this mechanism is inapplicable to technological innovation. The above results suggest that support increase the innovation incentives of R&D personnel in MSEs, but the effect of innovation incentives only plays a role in managerial innovation and not in technological innovation, which is what is needed for the construction of an innovative country.

The contribution of this study lies in the following three aspects:

First, unlike the existing literature that focuses on the effects of support on R&D inputs,financing, and investments, our study investigated the effects of innovation support on the wage gap of R&D personnel from the perspective of dedicated human capital, thus deepening the research on the implementation effects of support policies.

Second, based on the unique data of the CMES questionnaire, we not only explored the policy effects of innovation support in MSEs but also further examined the mechanism of innovation support in MSEs. The results strongly indicate that innovation incentives for R&D personnel are the core of innovation support in MSEs, which explains the innovation issues in MSEs in a more comprehensive way and broadens the scope of firm size for subsequent studies.

Third, taking China’s goal of creating an innovative country as the research context, we attempted to distinguish the effects of support on technological innovation and managerial innovation behaviors of MSEs, which is of significant reference for understanding the government-industry interactions in the implementation of support policies in China.

The following structure is arranged as follows: the second section renders the research hypotheses, the third section presents the data and variable descriptions, the fourth and fifth sections report the empirical results, and the final section contains our research conclusions.

Research Hypotheses

Influence Degree of Support on Innovation Incentives of R&D Personnel

Wage is the result of initial social distribution, and government support is a part of social redistribution. Empirically, the gap between R&D wage and staff wage was used to measure the innovation incentives of R&D personnel. Based on the existing literature, the wage gap is influenced by various factors, including company characteristics and internal governance, but also the external macroeconomic environment and government wage control policies (Lin et al., 2003; Fang &Li, 2015). In China, most of the studies on support and the wage gap have been explained by the management power theory, which argues that support enable executives to increase their pay by“faking” corporate performance targets for personal gains (Luo 2014; Bu & Wang, 2014; Tong &Chen, 2017). Although the wage gap has received widespread attention, the domestic literature has not yet focused on the R&D personnel’s wage gap; in knowledge-intensive production, human capital is as important as physical and financial assets in the innovation process, and varied employment relationships provide different incentives for employees to develop human capital and technological innovation (Filippo, 2012). Therefore, in this study, the determinants and mechanisms of the R&D personnel wage gap in MSEs were explored based on the CMES data, which specifically inquired about the wage of professional and technical personnel.

In the institutional context of the economic transition, when Chinese enterprises face huge capital needs for talent building and technological upgrading, fiscal support help ease the burden caused by the rising cost of raw materials and employee wages, which leaves more space for industrial transformations and upgrading. The supported enterprises will have more money to invest in equipment upgrading, talent building, and other projects closely related to technological innovation. For MSEs, the financial support from support is crucial due to their poor economic strength and ability to resist risks. Consequently, how to ensure that the money is well spent has become a pressing issue. CMES data shows that in 2014 and 2015, 16.7 percent of MSEs closed down each year. Unlike large and medium-sized enterprises, which have sufficient latency for technology introductions and equipment investments, MSEs should invest more money in introducing professional and technical talents, which is the most effective way to address the existing survival dilemma. Therefore, we proposed the following hypothesis:

H1: Support increase the R&D wage in MSEs, widening the wage gap with staff.

Effects of Support on Innovation Incentives of R&D Personnel

There are two opposing theoretical perspectives on the motivational effects of the wage gap.The tournament theory believes that widening the internal wage gap can enhance the performance of the whole enterprise (Edward, 1981; Sherwin, 1986), while the behavioral theory argues that an excessive wage gap will reduce employees’ enthusiasm which will have a negative effect on enterprise performance (Siegel & Hambrick, 1996). At present, the vast majority of the Chinese literature on the economic consequences of the wage gap supports the tournament theory. Liu and Sun (2010) Li and Hu (2012) analyzed the influence degree of the wage gap on enterprise performance in different regions using state-owned assets data, and this incentive shows heterogeneity. Based on the data of listed enterprises, Liang et al. (2019) found that the market value of an enterprise increases as the internal wage gap widens, and the incentive elasticity differs for enterprises in varied life stages.

However, only a few domestic scholars have studied the linkage between the wage gap and innovation behavior based on micro firms. Kong et al. (2017) found that the wage gap has an incentive effect on enterprises’ innovation behavior, and this incentive effect is mainly at the strategic level. He and Zhang (2018), on the other hand, held that the rise of labor costs plays a higher role in substantive innovation than strategic innovation, while the wage gap, in turn,promotes innovation to a certain extent. At present, academic discussions on the wage gap and innovation do not make a strict distinction between large and medium-sized enterprises and MSEs. Some studies take listed companies or private enterprises as research objects, and other studies also have deficiencies in their samples, such as small regions, small sizes, and limited industries. As a result, the further focus of this study is to explore the effect of innovation incentives on R&D personnel’s wage gap in MSEs as well as the innovation outputs.

There is a huge natural difference in size between MSEs and large and medium-sized enterprises, which leads to MSEs’ poor ability to resist innovation risks. Coupled with their disadvantages in capital, technology, and achievement transformation, MSEs’ innovation motivation is severely inhibited. Consequently, MSEs often choose development projects with little investment but quick results. As a result, compared with traditional technological innovation in terms of new products, technologies, and processes, supporting R&D personnel through wage incentives bring more management innovation with respect to service, marketing, organizational system, and culture. Therefore, we proposed the following hypothesis:

H2: Through the widened wage gap, support increase managerial innovation in MSEs, not technological innovation

Data and Variables

Samples

In this study, the data sources are from the CMES, a field survey of MSEs’ legal entities published by the China Household Finance Survey (CHFS). To obtain the overall unbiased estimation of MSEs and keep samples representative, the CHFS adopts a strict stratified random sampling, which fully considers the industry, enterprise, and regional differences. The survey sample includes 5,601 Chinese MSEs. The main survey contents involve MSEs’ information on production and operation, human resource management, R&D and innovation, financing,finance, taxation, organization and management, and operating environments in 2014. Due to the limitation of the questionnaire, CMES only inquired about innovation support for enterprises in manufacturing, software and information technology services, information transmission, and electricity, heat, gas, and water production and supply industries, so the proposed research objects are limited to the above four industries. To ensure data validity and eliminate the influence of abnormal samples, all continuous variable samples were winsorized at the 0.5 percent level.Finally, 442 observations were selected after removing the missing values.

Definitions of Variables

Support.

In the CMES data, 18.78 percent of MSEs received innovation support in 2014, of which the average support amount for supported MSEs was RMB235,900. Based on the work of Huang(2018), we used the natural logarithm of corporate innovation support as the main variable, which was set to zero if there was no support.

Wage gap.

In enterprises, R&D personnel often hold key resources and core capabilities and directly undertake pioneering tasks in innovation activities. For this reason, it is crucial for enterprises to motivate the R&D personnel and stimulate their innovation desires and abilities. There are many innovation incentives for R&D personnel. The common ones include income incentives and stock option incentives (Yang & Li, 2004). Limited by the fact that CMES only investigated the wage incentives of professional and technical personnel and did not investigate the related data of stock option incentives, this study refers to the research of Kong et al. (2017) and defines the ratio between the average professional and technical staff wage and the average staff wage as the gap between R&D wage and staff wage. Among them, the average staff wage is the average wage of regular employees in the survey questionnaire. If the enterprise has no regular employees, the average wage of non-regular employees will be used instead.

Innovation.

Innovation refers to the incentive of R&D personnel to achieve the enterprise’s desired innovation goals and to enhance the innovation capability, which is best expressed by the innovation output (Zhou et al., 2012). CMES data classify innovation output into technological innovation and management innovation. In the traditional sense, innovation outputs regarding new products, technologies, and processes belong to technological innovation, while innovation outputs regarding services, marketing, organizational systems, and culture fall within management innovation. Based on the existing empirical literature (Li & Zheng, 2016; Kong et al., 2017; He & Zhang, 2018) that studies the innovation behavior of listed enterprises, this study will explore the effect of innovation incentives for R&D personnel in MSEs from perspectives of both technological and management innovation. This is because, for MSEs, technological innovation is to promote the enterprises’ technological progress to obtain a competitive edge,whereas management innovation is simple, formal, and less sustainable.

Other control variables.

Based on the research model of Huang (2018), this study controls not only for the personal characteristics of MSEs’ major owners: age, education, work experience, or entrepreneurial experience,but also for the enterprise characteristics: total asset size, operating revenue, asset-liability ratio,industry type, and trade association relationship. The CMES data only collects bank loans and private borrowings of MSEs, so the two were summed in this study and used as the total liabilities to calculate the asset-liability ratio. Due to the limited sample and the incorporation of industry dummy variables in this study, the per capita GDP of each province was used in this study to control for regional differences.

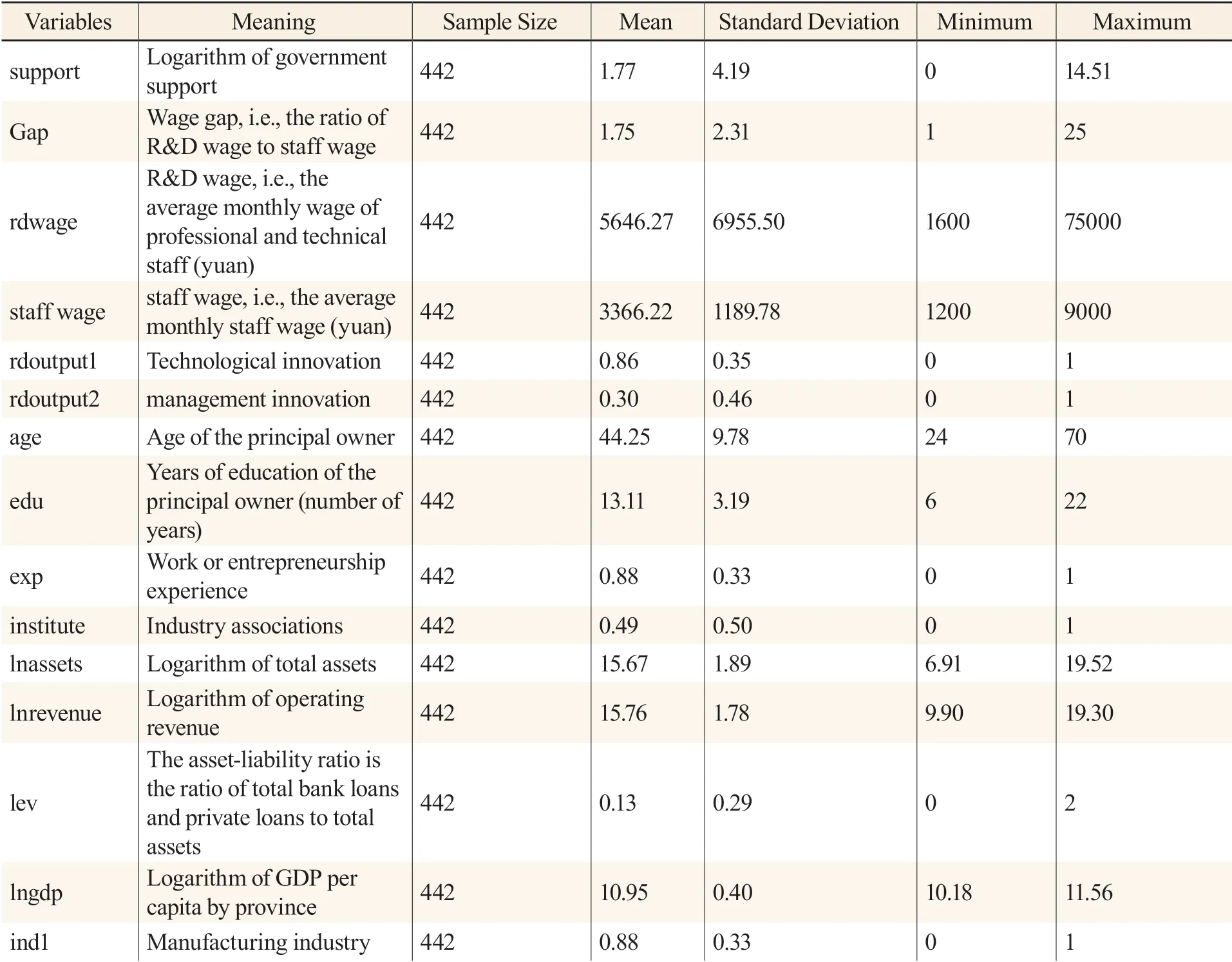

Descriptive Statistics

According to Table 1, the mean difference between the R&D wage and staff wage in MSEs was 1.75 in 2014, where the average monthly R&D wage was RMB5,646.27, and the staff wage was RMB3,366.22. R&D wage is thus significantly higher than staff wage. For innovation output, 86 percent of MSEs have technology innovation outputs, and 30 percent of MSEs have management innovation outputs, which is consistent with the current context of “the initiative of mass entrepreneurship and innovation” in China.

Table 1 Descriptive Statistics of Variables

Variables Meaning Sample Size Mean Standard Deviation Minimum Maximum ind2 Software and information technology services industry 442 0.08 0.27 0 1 ind3 Information transmission industry 442 0.03 0.18 0 1

Study on the Influence Degree of Support on the Innovation Incentives of R&D Personnel in MSEs

Baseline Regression Model

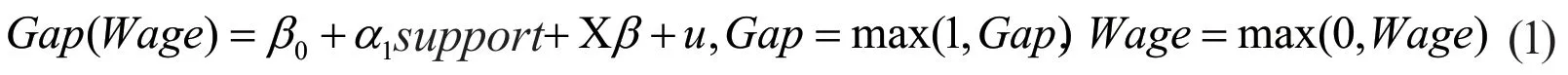

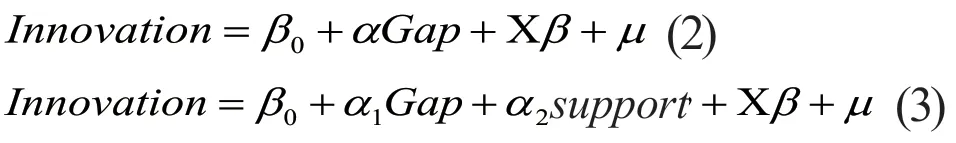

In order to investigate the influence degree of innovation incentives for R&D personnel in MSEs, this study takes the gap between R&D wage and staff wage, the average R&D wage and the average staff wage, respectively, as explained variables, with the purpose of examining whether innovation support widen the wage gap of MSEs and improves the wage incentives of R&D personnel as well as staff, as shown in Model (1). Due to the left broken-tailed distribution of the wage data, the Tobit model was used for estimation in this study.

where, the dependent variableGapdenotes the gap between R&D wage and staff wage,andWagedenotes the remuneration. The independent variablesupportdenotes the amount of government innovation support, andXis a control variable, specifically the characteristic variable for enterprise owners and enterprise characteristic variables, as shown in Table 1. In addition,we controlled for industry and added the GDP per capita variable for each province to control for regional heterogeneity.

Table 2 reports the regression results of Model (1). The coefficientsupportis positive in Column 1 and significant at the 1 percent level, which indicates that the innovation support can widen the gap between R&D wage and staff wage in MSEs. Specifically, the coefficientsupportin Column 2 is significantly positive and the coefficientsupportin Column 3 is not significant,which indicates that the main reason for the widened wage gap is that support increase R&D wage but have no effect on staff wage. This finding is consistent with the optimal support scheme proposed by An et al. (2009): Enterprises raise the price of dedicated human capital for original innovation through support, which will maximize the positive effect of support.

Table 2 Effect of Support on Wage Gap

The coefficients control variables indicate that those MSEs that joined their industry association have a significantly higher wage gap than those MSEs that did not join their industry association. The younger and more educated the MSEs’ major owner, the larger the MSEs, the higher the operating revenue, the lower the leverage, and the larger the gap between R&D wage and staff wage. In addition, the major owner’s work experience has a negative correlation with the wage gap, and all of the above are consistent with intuitions.

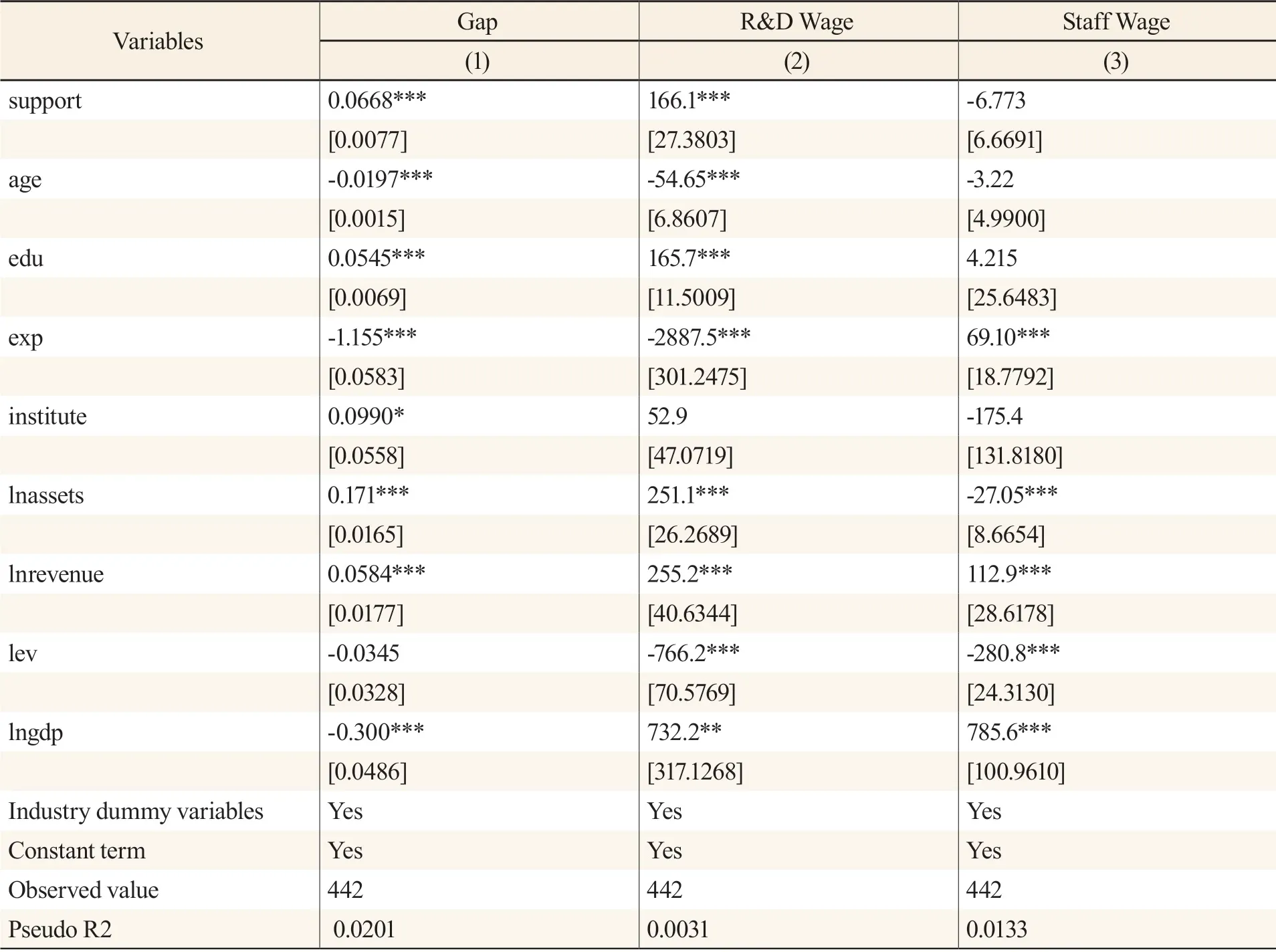

Robustness Test

To ensure the robustness of the results, this study calculated the weighted average of staff wage by the number of regular employees and non-regular employees and examined its effect on the wage gap in MSEs. The findings show that the coefficientsupportis significantly positive at the 1 percent level, which is consistent with the benchmark results, as shown in Column 1 of Table 3.

Endogeneity Test: Instrumental Variables

The benchmark regression results of support to the gap between R&D wage and staff wage may be disturbed by endogeneity. On the one hand, the year 2014 was taken as the time range in the CMES survey, so there may be endogeneity caused by reverse causality between them.However, the gap between R&D wage and staff wage in 2014 affects the support in future years,so reverse causality does not exist. On the other hand, although this study controls for enterprise owners and enterprise characteristics, provinces, and industries, there are limited questions in the questionnaire, and other key explanatory variables may be missing. For instance, the inflow of R&D talents or other talents may lead to a false causality between support and the wage gap.Therefore, in this study, instrumental variable regression was used to alleviate the endogeneity from missing variables.

Referring to the approach of Huang (2018), this study constructed instrumental variables with support other than innovation and used the Ivtobit model for estimation. Any type of support is to alleviate the financing constraints of enterprises through financial support, and support are related to the government’s administrative efficiency. Local governments that provide enterprises with adequate innovation support also help enterprises in other areas, so innovation support are correlated with support of other types. Additionally, support of other types do not directly affect R&D wages,so they are exogenous. Column 2 of Table 3 shows that support is significantly positive, which is consistent with the benchmark regression results and verifies the robustness of the results.

Table 3 Robustness and Endogeneity Tests of Support and Wage Gap

Heterogeneity Analysis

According to the Regulations on the Criteria for the Classification of SMEs, small and microenterprises are distinguished by their operating revenue and the number of employees. By analyzing the regression results of the empirical models in columns 1 and 2 in Table 4, we found that: Innovation support have a more prominent effect on the wage gap for small enterprises than for micro-enterprises. This suggests that due to innate resource disadvantages, such as industry barriers, excessive competition, and financial repression, as well as high corporate transaction costs resulting from excessive government interventions in the micro-economy and the prevailing official rent-seeking activities, MSEs are unable to obtain reasonable innovation support, where the problem of micro-enterprises is more prominent (Zhang et al., 2015). According to CMES data,in four industries, 7.43 percent of micro enterprises received innovation support, with an average support of RMB69,700; 24.49 percent of micro-enterprises received innovation support, with an average support of RMB261,300. It is evident that the breadth and depth of micro-enterprises benefiting from innovation support are insufficient.

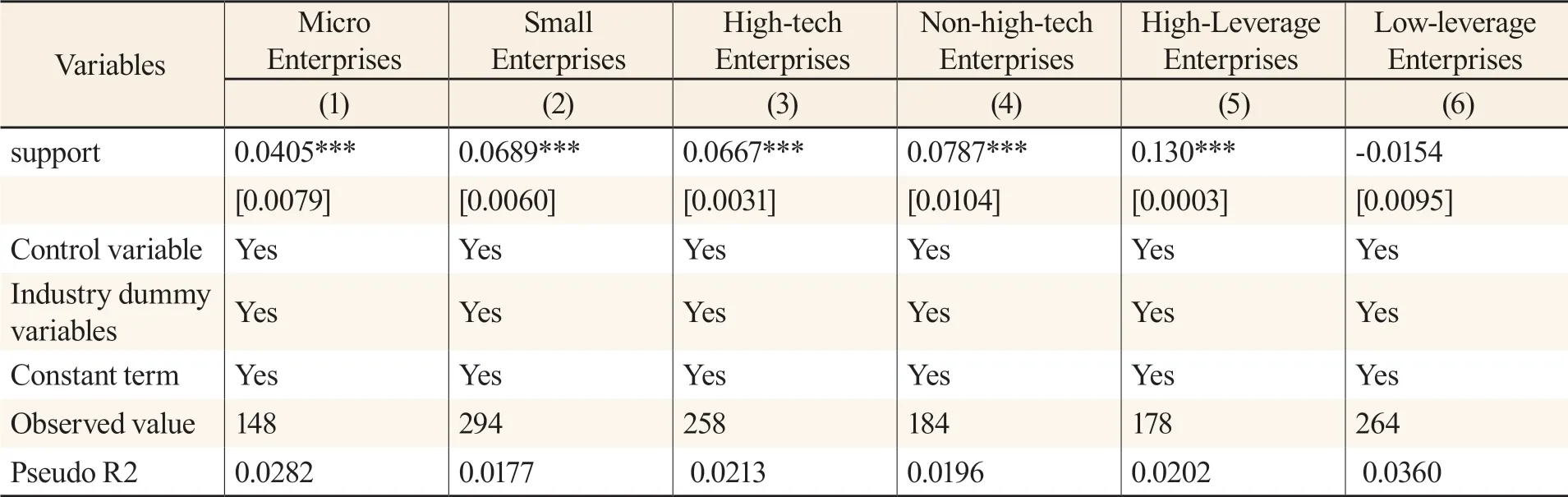

High and New-Technology Enterprise (HNTE) refer to resident enterprises that have been registered in the mainland for over one year, continuously carried out R&D and transformation of technological outcomes within the high and new technology fields supported by the State,formed the core independent intellectual property rights and conducted business activities on this basis. High-tech enterprises enjoy preferential tax incentives, such as additional deductions for R&D expenditures, accelerated depreciation of fixed assets, and a preferential income tax rate of 15 percent. Columns 3 and 4 of Table 4 show the estimations after grouping by high-tech enterprises. The coefficient of innovation support was significantly positive, and that of hightech enterprises was smaller than that of non-high-tech enterprises. This suggests that support received by non-high-tech enterprises have a more significant effect on the wage gap due to the crowding-out effect of tax incentives on support (Liu, 2016; Lin et al., 2013; Lu et al., 2014; Huang& Deng, 2012). This study also groups enterprises by their median asset-liability ratio to verify the funding constraint mechanism of support in a more direct manner. According to the results in columns 5 and 6 of Table 4, support have a positive effect on the R&D wage gap for high-leverage enterprises. For low-leverage enterprises, support have a negative and insignificant effect. This indicates that support widen the wage gap of MSEs by alleviating the financing constraints. This conclusion also demonstrates that the government provides financial support for MSEs through support to help overcome various uncertainties and enable MSEs to have sufficient conditions for innovation (Lin, 2002).

Table 4 Heterogeneity Analysis

Effect of Support on the Innovation Incentives of R&D Personnel in MSEs

Mediating Effect: Wage Gap and Innovation

At present, innovation is a decisive factor in driving China’s sustainable economic growth. As a public good, there are significant externalities in the outcomes of innovation activities, and the resulting insufficient innovation may hinder China’s economic growth. To correct market failures,the Chinese government has generally adopted financial innovation support and encouraged“the initiative of mass entrepreneurship and innovation.” For further analysis of the effects of the innovation support policy, the Probit model was used in this study to empirically explore the effect of the gap between R&D wage and staff wage on the innovation outcomes of MSEs. Based on the research of Huang and Deng (2012), the following model was set:

where, the dependent variableInnovationdenotes innovation outcomes, and based on CMES data characteristics, innovation outcomes include technological innovation regarding new products, technologies, or processes, as well as management innovation regarding organizational culture and marketing service approaches. The independent variableGapdenotes the gap between R&D wage and staff wage. The remaining variables are the same as Model (1) and will not be repeated.

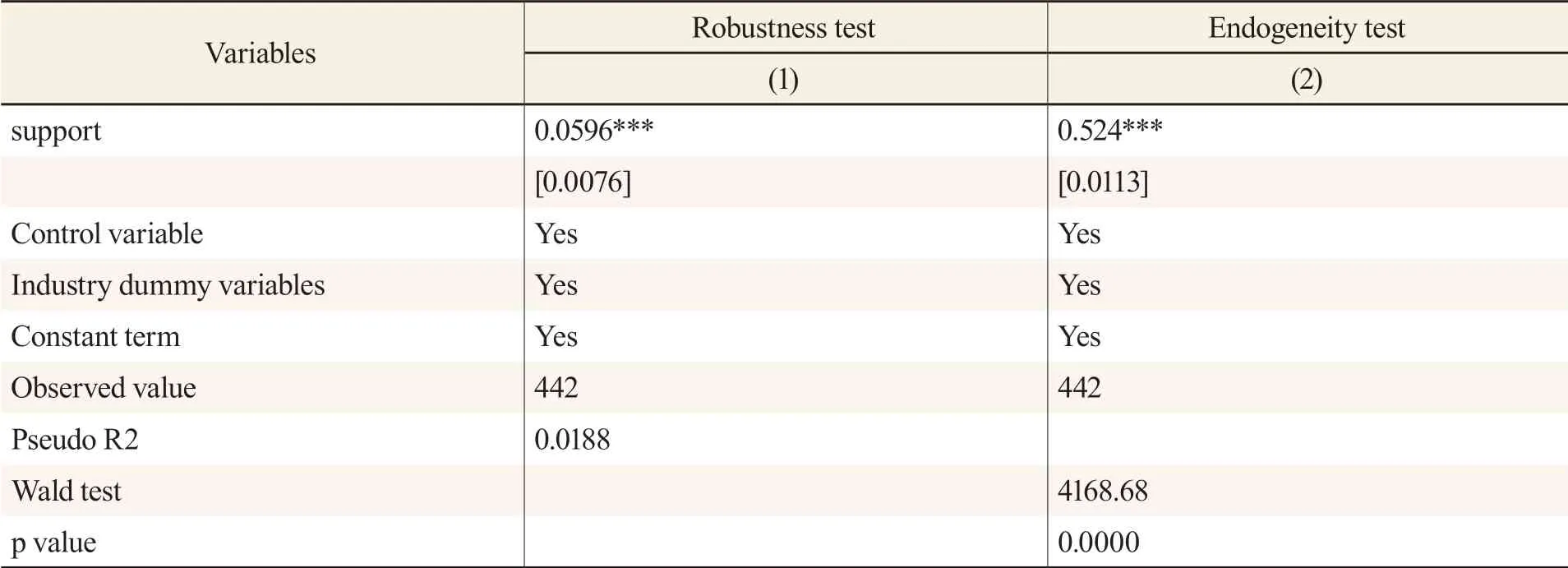

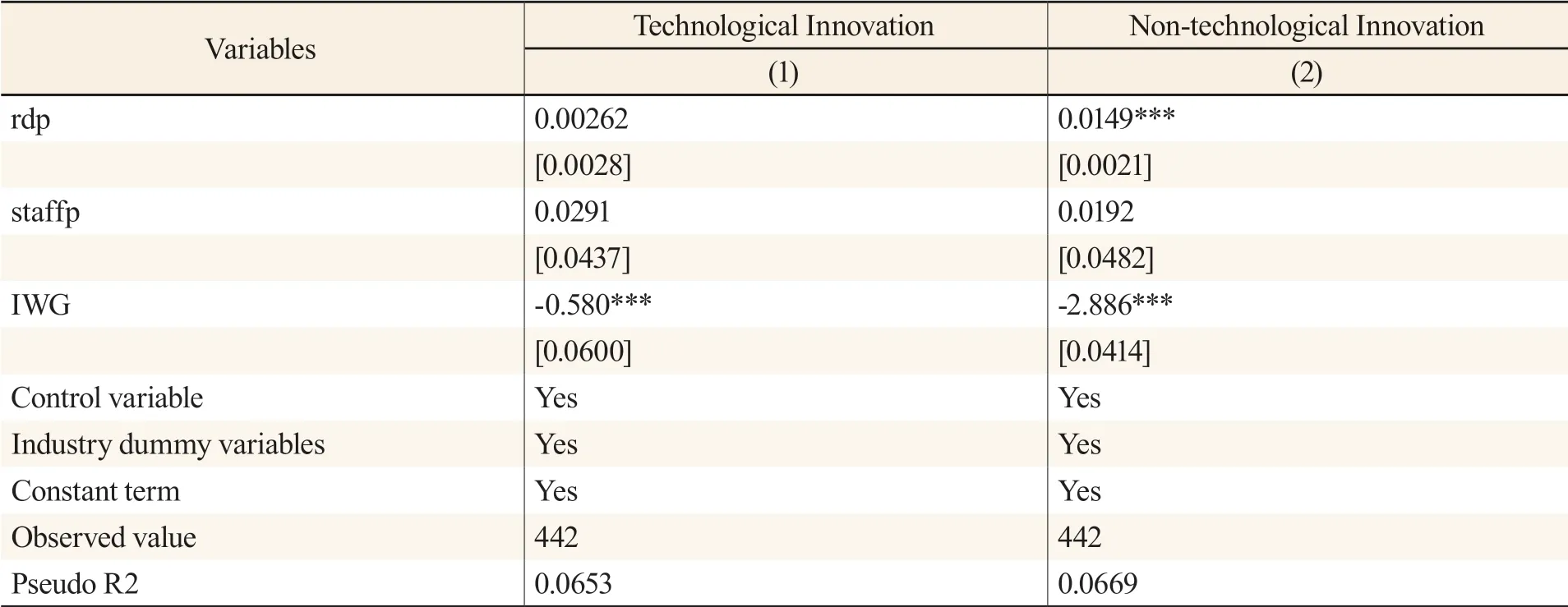

Table 5 shows the results of the mediating effect. Combined with the mediating effect test procedure of Wen et al. (2004), this study finds that the wage gap does not have a mediating effect between support and technological innovation (the coefficientGapin Column 1 is not significant). There is a partial mediating effect between support and managerial innovation(the coefficientsGapandsupportin Columns 3 and 4 are both significantly positive at the 1 percent level, and the marginal effect ofGapbecomes smaller due to the introduction of the coefficientsupport). Therefore, innovation support improve the enterprises’ managerial innovation outcomes by widening the gap between R&D wage and staff wage in MSEs.There are two reasons that only affect management innovation. On the one hand, due to the difficulty of technological innovation, MSEs are limited by their own resource endowments,such as company size, financing constraints, and industry barriers (Lin et al., 2009); on the other hand, Chinese enterprises prefer to pursue strategic management innovation with the quick result, thus neglecting substantive technological innovation (Yang, 2020; Li & Zheng,2016; Kong et al., 2017).

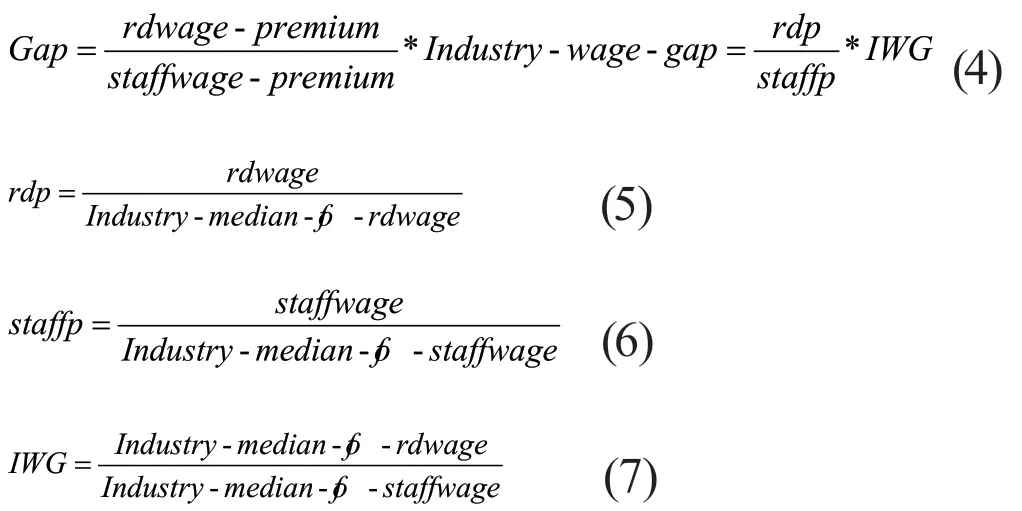

Decomposition Effect: Wage Premium

In this part, potential mechanisms of the gap between R&D wage and staff wage in MSEs affecting innovation were explored. To identify the source of innovation incentive caused by the wage gap, this study separates the innovation effect of R&D wage and staff wage. The wage comparison exists not only within the same enterprise but also between different enterprises in the same industry. Based on the research of Kong et al. (2017), this study decomposes the gap between R&D wage and staff wage according to the following equations:

where,rdpdenotes R&D wage premium, or the ratio of average R&D wage to its industry median, which reflects the wage comparison between R&D personnel from different enterprises in the same industry;staffpdenotes staff wage premium or the ratio of average staff wage to its industry median, which reflects the wage comparison between staff from different enterprises in the same industry;IWGdenotes industry wage gap or the ratio of the industry median of average R&D wage to the industry median of the corresponding average staff wage.

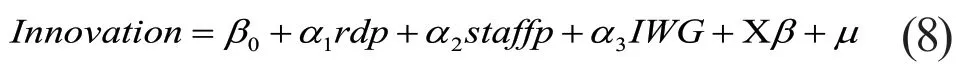

Therefore, Model (1) is extended as:

The statistical results are shown in Table 6. In line with the results of Model (2), the wage gap of MSEs only plays a role in management innovation, and the marginal effect of R&D wage premium is 0.0149***, indicating that R&D wage incentives produce a positive marginal effect on management innovation regarding organizational culture and marketing service approach, a result consistent with He and Zhang (2018). Furthermore, the coefficient staff wage premium is positive and not significant, which indicates that staff wage premium has no significant effect on innovation.The comparison of the two variables indicates that R&D wage premium is the main driver of management innovation in MSEs, and this finding supports the tournament theory of wage gap.

Table 6 Decomposition Effect: Wage Gap and Innovation

Conclusions

As a major engine of national economic growth, MSEs play a key role in growth stabilization,employment increases, innovation promotion, market prosperity, social harmony maintenance, and satisfaction of residents’ needs. Based on the industry-wide CMES field survey data, the research results of the effect of fiscal support on corporate innovation through R&D wage incentives, which uses the macro-control measure of fiscal and taxation supports, are summarized as follows: First,support significantly increase the MSEs’ R&D wage and widen their gap with staff wage, indicating that support influence innovation in MSEs through dedicated human capital inputs. Second, further analysis of enterprise groupings reveals that compared to micro enterprises (high-tech enterprises and low-leverage enterprises), the gap between R&D wage and staff wage increases significantly when small enterprises (non-high-tech enterprises and high-leverage enterprises) are encouraged by support.R&D wage and wage gap increase significantly for small enterprises (non-high-tech, high-leverage enterprises) when they are supported relative to micro firms (high-tech, low-leverage enterprises).This indicates that while support policy affects innovation incentives of R&D personnel, the scale effect, tax preference crowding out effect, and financing constraint effect are also in play. Third,support stimulate innovation more as management innovation rather than technological innovation.For the supported enterprises, management innovation, rather than technological innovation,increases during the year, and the support of management innovation derive from the R&D wage premium. This shows that although support motivate R&D personnel to innovate, R&D personnel choose management innovation that is short-cycle, low-risk, low-cost, with quick results, and reject technological innovation that can truly improve the market value of MSEs.

Based on the above conclusions, we propose the following policy recommendations.

First, improving the support disbursement and evaluation mechanism and promoting the innovative technology voucher system. Given the urgent need for government support for MSEs, it is recommended to expand the scope of support disbursements, strengthen the support disbursements, and improve the process of support disbursements so that more MSEs who aspire to innovation may enjoy the benefits of the policy. In recent years, the innovation voucher system for SMEs has been a direct response to the lack of innovation resources and insufficient innovation motivation in SMEs. Through the issuance of innovative technology vouchers,enterprises are linked with research institutions and universities to form an organic combination of industry, university, and research, which is a beneficial exploration for China to reform the way of financial investments in science and technology from a market-oriented direction.

Second, strengthening the building of human capital. Rational enterprises will establish a mechanism of cultivation, use, evaluation, and incentives for R&D personnel, so that the R&D personnel may benefit from sharing the corresponding value of human capital and releasing the dividend of population quality. This not only stimulates the initiative, enthusiasm, and creativity of R&D personnel but also forms an innovation thrust for the effective demand scale of enterprise innovation. As a result, a virtuous cycle between employee wage and enterprises’ innovation vitality can be formed, thus facilitating the high-quality development of enterprises. Additionally,exogenous government interventions will also provide more innovation incentives.

Third, implementing differentiated policies. It is necessary to implement differentiated support policies and refine innovative behaviors in terms of difficulty, depth, and potential value. For high-tech R&D projects, the competent departments may combine with preferential tax policies to increase support and promote technological innovation of enterprises. For enterprises of varied sizes, different incentive goals should be clarified on whether to improve economic profitability,expand corporate investments or address difficult corporate financing, and start from specific,clear goals to address corporate difficulties.

Fourth, creating a good market environment. Relevant departments should accelerate the marketization process, formulate strict property rights protection policies as well as relevant laws and regulations, improve the efficiency of capital market investments, and provide a fair and free competition environment to alleviate restrictions on private enterprises and MSMEs,protect their innovation activities, and give convenient conditions to their R&D investments.Moreover, relevant departments should guide vulnerable enterprises to implement scientific and technological innovation, improve the quality of innovation, facilitate technological progress, and realize industrial transformations and upgrading.

杂志排行

Contemporary Social Sciences的其它文章

- Rural Road Investment and Economic Growth

- Research on the Development of Rural Tourism in the Context of Comprehensively Promoting Rural Revitalization: A Social-System-Based Approach

- On the Development of Modern Tourism in Liangshan Yi Autonomous Prefecture, Sichuan Province

- A Study of Sanxingdui Museum’s Building of International Communication Capacity

- Enlightenment from Development Experience of World-Class Universities in Foreign Inland Regions

- Erasable/Inerasable L1 Transfer in Interlanguage Phonology: An Optimality Theory Analysis of /aʊn/and Sentence Stress in Chinese Learners of English