Textile sector in the EU returns to pre-pandemic level!

2022-07-12

T&C sector plays an important role in European manufacturing. Countries with developed textile in—dustry in EU include Germany, Spain, France, Italy, Switzerland, etc. Its output value accounts for more than one—fifth of the global textile industry, and cur—rently it is worth more than 160 billion dollars.

As home to hundreds of leading brands, interna—tionally renowned designers, as well as forward—looking entrepreneurs, researchers and educators, the European textile and garment market not only sources its products from high—income countries such as the United States, Switzerland, Japan or Canada, but also from emerging countries and regions such as China, Russia, Turkey and the Middle East. Demand for high—quality textiles and high—end fashion products has been growing in Europe. In recent years, the transformation of European textile industry has also led to a sustained increase in the ex—port of industrial textiles.

Textile activity expanded further

Looking at the full year of 2021, the textile activ—ity has fully recovered from the strong contraction in 2020, while clothing companies have almost reached their pre—pandemic level. However, as a consequence of the COVID—19 pandemic, global supply chains and shipments slowed down, causing worldwide shortag—es and affecting consumer patterns. Persistent price surges of raw materials and energy weighed increas—ingly heavy on the T&C industry.

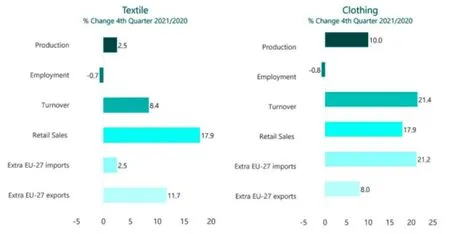

Textile activity expanded further in the 4th quar—ter 2021, although at a slower pace than in previous quarters. Performances in the clothing industry im—proved significantly during this period. Furthermore, EU exports and retail sales grew at a sustained pace, following strong domestic and external demand.

Attach importance to the R&D end

The EU Business Confidence indicator for the months ahead fell slightly in textiles (—1.7 points), probably reflecting their energy—related challenges, while the clothing industry is more optimistic (+2.1 points). To note however that managers’ confidence in both textiles and clothing remain higher than its long—term average and to pre—Covid level in Q4 2019. Besides, consumer confidence dropped, fol—lowing the collapse in households’ expectations about the general economic situation and their as—sessments of their own future financial situation, which fell to historical low. Similarly, the retail trade confidence dropped, mainly as a result of retailers’ assessment of their expected business situation. After a brief interruption end of 2021/beginning of 2022, selling price expectations for the next three months rose to unprecedented levels in the T&C sectors, due to the sharp increase in energy costs and raw materials.

Since the outbreak, the European textile indus—try has received renewed attention. Many changes have been made in the manufacturing process, re—search and development, and retail to maintain its competitiveness, with the textile industry in most EU countries shifting to higher value—added prod—ucts. As energy and raw material costs increase, the selling price of textiles and clothing in the Eu—ropean Union is expected to rise to unprecedented levels in the future.