The Next Generation EU (NGEU) promotes the transformation of fast fashion in Spain

2022-07-12ByZhaoXinhua

By Zhao Xinhua

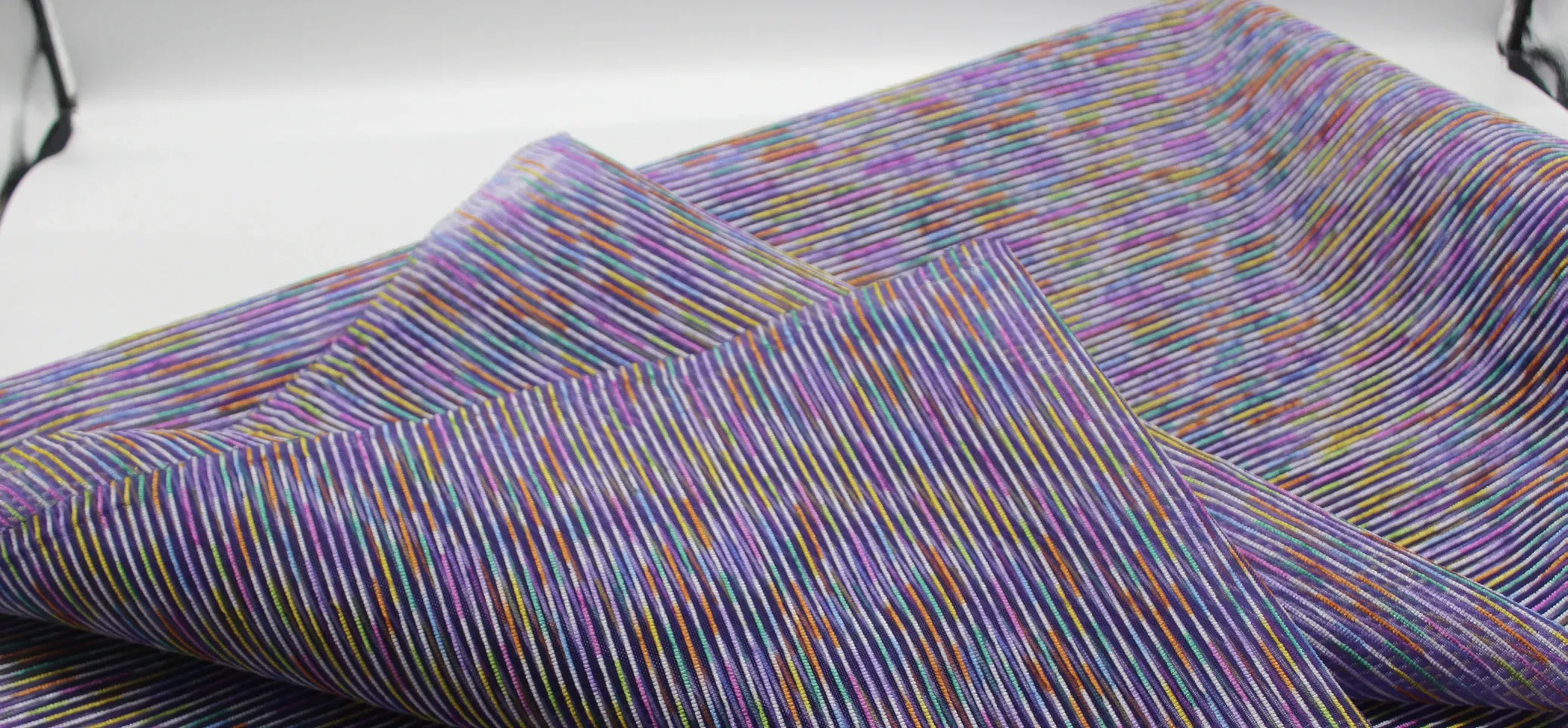

As one of the largest industries in Spain, the tex—tile and garment industry accounts for 3.3% of its GDP, ranking fifth in the European Union. Spain is not only an exporter of wedding dresses and fast fashion brands, but also a producer of textile machinery. In Spain, there are about 160 textile machinery enterprises engaged in spinning, weaving, clothing and dyeing and finishing machinery manufacturing. Some products have reached the leading level in the world, and can be compared with similar products in Germany and Italy. Because of their relatively favorable prices, they are favored by customers and sold all over the world. The textile industry has stabi—lized the country's economy, which is often in trouble.

The latest trends of Spanish textile

In the past, Spain faced fierce competition from Asia, especially China, as well as economic challenges brought about by the global economic recession and the decline of consumer and industrial demand. It provides a low—risk possibility for the fashion Spanish textile and clothing industry. Spain's fashion industry is very popular because of its low price and the characteristics that conform to the current fashion trend.

Spain's textile market also benefited from the with—drawal of inefficient textile enterprises. Currently, there are nearly 4,000 textile companies operating in Spain, and this number will not change in the next year. These surviving enterprises attach great importance to exports, which helps Spanish textiles industry to create new busi—ness prospects and markets. At present, Spain has been exporting textile raw materials to Morocco, accounting for a large part of its textile exports, which may promote the recovery of its textile industry in the near future.

Economic revival faces many difficulties

In recent years, the recovery of the industry has been hampered by the global outbreak of COVID—19, rising raw material prices, transport disruptions, and energy crises, with consequences in both supply and price increases. The Russia—Ukraine conflict in 2022 added to the un—certainty of the global environment, as these Spanish companies have traditionally been less competitive than their European neighbors amid rising inflation. Margins are getting so low as costs rise that many businesses have to choose between passing on the increased costs to customers or selling at no profit at all.

In 2021, Spain’s textile and apparel sales fell 13.10 percent from —41.26 percent in 2020. As a result, the in—dustry has yet to complete its recovery and faces a more complicated external situation in 2022. Starting from this year, as Spain begins to repay ICO loans and faces a new mutation of the COVID virus, the increase in the number of infections and possible restrictions put the textile trade in a worrying situation.

Spain and the EU take measures

The increase of energy costs has a dual impact on trade. First, it increases the structural expenditure of companies. Secondly, for consumers, this means that additional spending by households will reduce their pur—chasing power. Therefore, Spain will take measures to cushion this situation at the national and regional levels, the first is to address the problem of energy price increase and compensation measures; the second is to develop policies that help encourage consumption; the third is to take steps to control fixed costs and reduce the heavy burden on trade at such an important stage of recovery.

In 2022, the Next Generation EU (NGEU) will boost Spain’s textile and apparel industry. The main objective of the program is to facilitate the transition of companies to a digital and sustainable model that will enable them to compete on the new world stage in the textile and fashion industries. Spain will focus on the improvement of eco—designed industrial products, the development of new processes, the promotion of industry 4.0 digitization and waste management system, to leverage the circular economy in the Spanish apparel sector.

· Processes for improving manufacturing methods and developing new raw materials

· Support R&D projects to enhance recycling and digital manage—ment

· Improve business models to help SMEs

· Promote industry 4.0

· Support new energy models, logistics and training

· Make this revolution work for small and medium—sized busi—nesses as well as large ones