MARKET WATCH

2013-12-06

OPINION

How Can Central SOEs Reverse Losses?

The 2012 annual reports of listed central stateowned enterprises (SOEs)—or enterprises administered by a national state-owned assets supervisory body—revealed that some of them suffered heavy losses, which has aroused public concern and put these companies under greater scrutiny. Of course, losses should be tackled promptly, but in a rational way.

Some people believe losses originate from inefficiency and that all existing SOEs should be privatized as a result. This idea is meaningless. Reviewing the development history of SOEs in the past three decades,the last 10 years in particular, SOEs are sufficiently qualified to develop themselves in market competition, and their accomplishments are there for all to see.

For this reason, central SOEs should take cost and pro fit into consideration in their expansion plans, especially regarding mergers and acquisitions. It takes money to acquire a company. And since it is difficult to say whether the company can yield pro fits, central SOEs should be cautious with their decisions.

Central SOEs have their advantages, but it doesn’t mean they are omnipotent. Ef ficiency,instead of scale, should be given top priority when central SOEs are reorganized with mergers and acquisitions.

At the same time, central SOEs should also act in line with the law of corporate development. The essence of a business can be reflected in three aspects. First, it should try to meet market demands. If a company loses its customers, it will go bust. That means what it should keep in mind are who its customers are, who its customers should be, and who its customers will become.Second, it should make money. Third, it needs to fulfill corporate social responsibility. That means a company should spare no effort to eliminate all the negative effects of its production and operation, participate in market competition on an equal basis, and respect laws and regulations.

When a company does a good job on these three fronts, its true value can shine through.Currently, SOEs have to play too many roles,some of which go beyond the functions of an enterprise. The consequences are an increased burden and have twisted business behaviors. An enterprise cannot focus on its own business if it is given tasks that are beyond the scope of its functions.

When some central SOEs are in the red,they tend to take all possible measures to reverse losses, but it is essential to comply with the law of corporate development and clearly recognize the purpose of central SOEs. ■

This is an edited excerpt of an article by Xu Baoli from the Economic Research Center of State-owned Assets Supervision and Administration Commission of the State Council, published in The Beijing News

yushujun@bjreview.com

工笔花鸟细化的形式美很大程度上取决于在线条上的运用,整齐划一的线条需要扎实的功底,需要时间的打磨才能成就线条的力度美感,讲究在器物的身上线条需要一气呵成。

NUMBERS

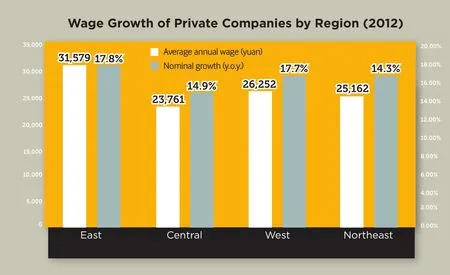

28,752yuan

Average annual wage of private company workers in 2012 17.1-percent nominal increase over the previous year

23,76y1uan

Average annual wage of private company workers in central China in 2012

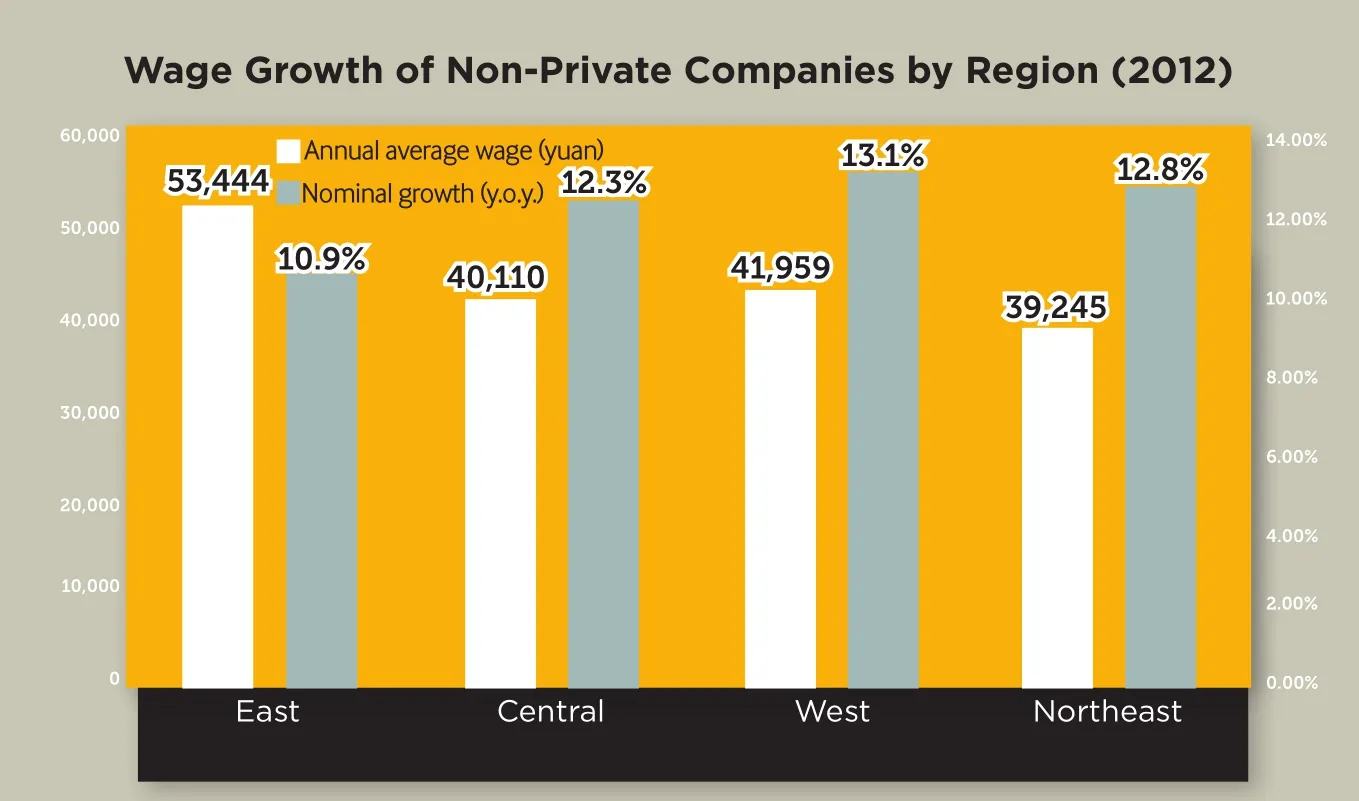

53,44y4uan

Average annual wage of non-private company workers in east China in 2012

(Source: National Bureau of Statistics)

THE MARKETS

Joint Dairy projects

French food giant Groupe Danone SA will invest about 325 million euros ($417.17 million) in two joint projects with China Mengniu Dairy Co. Ltd.,a move that will help improve Danone’s sliding market share in China and restore consumer con fidence in the country’s dairy market.

Danone signed an agreement with China National Cereals, Oils and Foodstuffs Corp.(COFCO)—Mengniu’s largest shareholder—to form a joint venture in which COFCO will own a 51-percent stake and Danone 49-percent.

Meanwhile, Danone—the world’s largest yogurt maker—set up a joint venture with Mengniu to make and sell chilled yogurt products in China. Danone will own a 20-percent stake and Mengniu 80 percent.

Net sales are expected to reach about 500 million euros ($644 million), and the joint venture will run 13 factories across China with an estimated market share of about 21 percent.

Carmaker’s Acquisition

China’s second largest automaker Dongfeng Motor Corp. agreed to become a shareholder in Fujian Motor Industry Group Co. Ltd.

Dongfeng signed a framework agreement with the Fujian Provincial Government to acquire shares in the local automaker from its owner, the Fujian Provincial State-owned Assets Supervision and Administration Commission.

Dongfeng did not disclose in its official statement how many shares it agreed to acquire or the spec ific investment amount.

Dongfeng and Fujian Motor also plan to set up a new investment company, two thirds of which would be owned by Dongfeng.

The new investment company will replace Fujian Motor with a 50-percent stake in Southeast Motor, which now is a three-way venture among Fujian Motor, Japan’s Mitsubishi and China Motor Corp. from Taiwan. ■