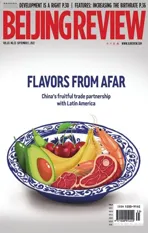

THE CHERRY ON TOP

2022-08-30ChinaandLACcountriesexpectnewpotentialineconomicandtradecooperationByZhangShasha

China and LAC countries expect new potential in economic and trade cooperation By Zhang Shasha

Workers pack cherries they have picked at an orchard in Chile on December 5, 2019

Guo Mingjuan has been in the cherry business since 2013, a time when imported cherries started gaining Chinese consumer favor. Starting out, her business was based in China, but in 2019 a friend asked her to jointly establish their own company in Chile. And so they did.

Their new undertaking proved a second bite of the cherry for Guo. The fruit’s red hue makes it a “lucky charm” in Chinese culture, and it brought her much happiness in her new home.

Apart from being lucky in love and meeting her Mr. Right, Guo’s cherry business thrived. Today, the company exports an average of 60 twenty-foot equivalent units of containers (about 19 tons per container) of cherries each year. According to the latest statistics from the Chilean Fruit Exporters Association, 88 percent of Chilean cherries were exported to China during the 2021-22 production period.

In recent years, exotic products from Latin America and the Caribbean (LAC), like Chilean cherries, Peruvian blueberries and Uruguayan dairy products, have become new favorites in Chinese shopping carts.

The economic and trade ties between China and the LAC region have moved from strength to strength over the past decade. The country has become the region’s second largest trading partner, only after the U.S. According to a report released by the UN Economic Commission for Latin America and the Caribbean(ECLAC), in 2020, exports of the LAC to the U.S. and the EU tumbled by 14 percent and 13 percent year on year, respectively, due to the COVID-19 pandemic, whereas its exports to China saw a year-on-year increase of 0.1 percent.

D a t a f r o m t h e G e n e r a l Administration of Customs of China(GACC) showed that total trade volume between China and LAC countries reached $451.59 billion in 2021, up 41.1 percent year on year and hitting a record high—despite the pandemic. From January to July this year, bilateral trade already reached$282.8 billion, up 14.4 percent over the same period last year.

“When it comes to China-LAC economic and trade cooperation,there is still much potential to tap into,” Wang Ping, Vice President of the China Association of Latin American History Studies, told.

Blooming business

Apart from cherries, Chilean wines,with their unique flavor—courtesy of the grapes grown in the distinctive geographical and climate conditions combined with the application of traditional European winemaking techniques—have become a favorite among Chinese wine connoisseurs.

“With its mellow and fruity flavor, Chilean wines are beginnerfriendly and cater to the Asian consumer palate,” Bai Ziyi, Sales Director with the Chilean VSPT Wine Group in China, told.

China has become the largest export destination of Chilean wines followed by Brazil and Britain,according to Wines of Chile, a non-profit, private organization of Chilean wine producers.

But whether it’s about cherries or wines, what are the real reasons behind the trade growth of LAC products against a generally downward global trend?

Zhang Yong, a researcher with the Institute of Latin American Studies (ILAS) under the Chinese Academy of Social Sciences, attributed the rising numbers to China sharing its pandemic prevention and control expertise with LAC countries, which proved conducive to the stabilization of the industrial and supply chains and facilitated their economic recovery.

“China’s economic resilience,huge market and growing demand for high-quality products have paved the way for the boom of LAC products in the Chinese market,” Zhang told. “Several LAC countries which are still adjusting their economic structures [to the new global environment] are eyeing the huge market opportunities and continue to diversify their products for export.”

Then there’s the tariff factor. “The most important trait of Chilean wines is their high cost performance,” Bai said, adding this has greatly contributed to the sales boom in China. Due to the free trade agreement (FTA) between both countries, consumers can get superb products at lower prices.

The tariffs on Chilean wines had been reduced year by year since the China-Chile FTA took effect in 2006, and in 2015 they were scrapped. According to the GACC, the exports of Chilean wines to China increased by 27 percent in 2015 alone, and Chile surpassed Australia to become the second largest source of bottled wines in China after France. In 2017, the FTA was further updated; since then, 97 percent of products have been entitled to zero-tariff status.

Aside from Chile, Peru and Costa Rica, too, have signed FTAs with China. On February 6, the China-Ecuador FTA negotiations officially got underway.

“Ecuador is famous for its white shrimp, bananas and flowers; if the FTA is reached and implemented in the future, Chinese consumers will be able to obtain those products at lower prices,” Yue Yunxia,Associate Director of the Department of Economics,ILAS, told. “For Ecuador,the competitive pricing will help grow its exports to China.”

“The scope of an FTA goes well beyond tariffs;it facilitates trade and investment and boosts overall economic cooperation,” Yue added.

This year specifically, the good news for China-LAC economic and trade cooperation has been coming in nonstop, laying a solid foundation for bilateral development. With Nicaragua and Argentina participating in the Belt and Road Initiative,21 out of 24 LAC countries that have established diplomatic relations with China have thus far become participants of the Chinaproposed initiative aiming to improve transcontinental connectivity and cooperation.

Basket to pocket

For entrepreneurs like Guo and Bai,their cherry and wine career opportunities sprouted from the bilateral trade.

For Chinese consumers, exotic products fill a seasonal gap when domestic produce cannot meet their needs.

Guo toldthat the picking season of Chilean cherries coincides with the Spring Festival,or Chinese New Year—the biggest festival in China. Consumers had fewer fruit options during this holiday, which usually occurs in January or February, but because the massive annual celebration demands a fruit feast, it generated a boom in Chilean cherry sales.

A visitor picks up a Peru-made furry alpaca toy at the China International Fair for Trade in Services in Beijing on September 6, 2021

Workers pour concrete to lay the foundation for a China-Argentina joint hydropower megaproject on the Santa Cruz river in south Argentina on November 18, 2020

“The Chileans are committed to exploring new cherry varieties that can be picked earlier to make up for the lack of cherry supplies to China during September and October as well as to further tap into the greatest potential of the country’s consumption market,” Guo said.

Apart from agricultural products, LAC industrial raw materials,metal and mining products have all made their way into the Chinese market. In return, people in LAC countries have been able to pocket the financial benefits.

Amapá is a state in Brazil, with a great portion of its area covered by the Amazon Rainforest. With no interstate highways around, the only way to get to the outside world used to be via water or air. Locals mainly depended on the fishing industry for food and income, but the growing soybean trade with China has generated big changes in the state.In the past six years, its soybean planting area grew ten-fold and perhectare output saw an increase of more than 50 percent.

“Soybean exports have increased our income and improved our living conditions,” local farmer Evan Thomas told. He further explained how the local government had renovated the roads and reconstructed the ports to facilitate exports.

In the first nine months of 2021, trade volume between China and Brazil exceeded $164 billion,up 37 percent year on year. The Brazilian Central Bank stated in a report in 2021 that China’s domestic consumption has significantly spurred Brazilian exports.

Brazil’s Minister of Foreign Affairs Carlos Alberto Franco França said in 2021 that relations with China are one of the priorities of Brazil’s diplomacy and the country hopes to further strengthen economic and trade exchanges with China.

In addition to trade cooperation, China’s investment in LAC countries has increased year by year.“The improvement will benefit infrastructure construction and economic development in the LAC region,” Wang said.

Infrastructure is one of China’s most competitive fields and the LAC countries have great demand for it. From 2005 to 2020, there were 138 China-LAC joint infrastructure projects, valued at $94 billion,and creating 600,000 jobs for locals, according to academic research website Cnxueshu.com.

Room for improvement

Despite the huge potential, China-LAC economic and trade cooperation does face several challenges.

Guo pinpointed several obstacles for the expansion of her cherry business, mainly Chile’s underdeveloped infrastructure and logistics.

Unlike Guo, one of Bai’s major concerns is that Chinese people still lack brand awareness and wine products are not graded properly.At the mention of “wine,” people will first think of France. The overall industrial chain is relatively incomplete; this will be a key issue to solve in the future.

Both Guo and Bai added that the difficulties will not limit the future of bilateral cooperation, and said they believed their “red” businesses—red fruit and red wine—are bound to benefit more people on both sides of the world.

Wang said both sides should take their own development needs as a basis for intensifying the trade ties, make full use of their advantages and expand room for collaboration.

China and the LAC region each have their advantages in agricultural and resource-oriented products,infrastructure and e-commerce,“and they should be aware of their strengths and tap into the potential for cooperation in these areas,” she added.

Trade in services marks yet another opportunity. Wang raised the example of creating a mechanism for enterprises from both sides to meet their common needs under the conditions of the digital economy.

More importantly, Wang suggests deepening multilateral cooperation. With time and within current mechanisms such as BRICS, Group of 20 and the World Trade Organization, China and LAC countries can try exploring new ways to advance global economic and trade governance reforms. BR