Cotton Market Fundamentals & Price Outlook

2018-07-27

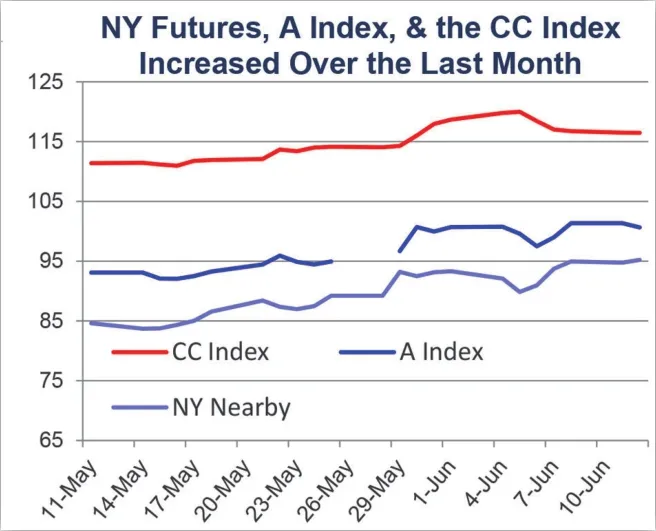

Price outlook

The pattern of movement suggests that the latest round of global volatility originated in China. In response to domestic volatility, the Chinese government made a series of announcements in early June. Generally, these statements emphasized the existence of adequate supply in the near-term and the ability to secure additional cotton as needed into the future. Specific comments indicated that reserve volumes are sufficient, and that the current round of sales can be extended an additional month (initially scheduled from March through the end of August, but can continue through the end of the September as has been done the past two years). To curb speculation in cotton sold from reserves, the government banned traders/merchants from buying at auction (only spinning mills can buy, and mills are prohibited from reselling).

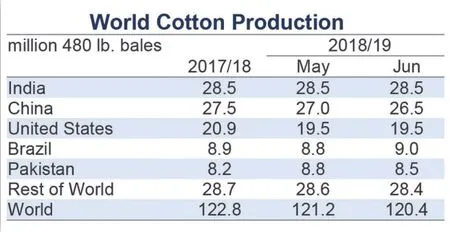

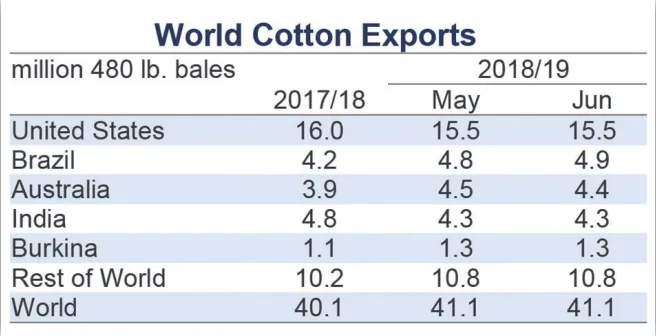

Beyond currently warehoused supplies, Chinese officials indicated that adverse weather throughout the spring in the important Xinjiang province(home to 75-80% of Chinese production) should have only a limited effect on yield, and that fears of a collapse in the domestic harvest were overblown. Importantly for the rest of the world, the Chinese government also reported that plans are in place to increase import quota, with officials indicating that sliding-scale quota can be released in the near future.

These comments highlight a central source of uncertainty for the global cotton market during the 2018/19 crop year, which is how much more China cotton may import. With dry conditions affecting the largest growing region of the largest exporting country (West Texas, U.S.),the possibility of stronger than forecast Chinese imports underline the possibility of lower than expected ending stocks outside of China.Current USDA forecasts suggest that ending stocks outside of China will increase in 2018/19, adding to the record volume estimated for 2017/18. This volume will serve as a buffer against rising Chinese import demand, but there are questions about the accuracy of the USDA’s estimate for non-Chinese stocks (e.g., wide separation between USDA’s number for Indian stocks relative to domestic estimates). The actual volume of stocks available for export to China, as well as the size of the increase in Chinese imports can be expected to determine price levels in 2018/19 and beyond.

杂志排行

China Textile的其它文章

- Liu Zibin:We have kept the pace with the great era

- Zhao Linzhong:Witness 40 years of historical changes and narrate the course of“ideological emancipation”

- To the New York Shows for new opportunities among various challenges

- 30 years of Jigao brings benefit to a city, 20 years of Tianzhu changes an industry

- Newly increasing export earning of 100 million USD: Phase II Project of D&Y Textile (Malaysia) Sdn. Bhd. was officially put into operation

- Let intangible cultural heritage walk into the daily life