An Analysis of Dividend Policy of Chinese Public Company

2017-07-28张玮纯

张玮纯

CHAPTER 1 Background

With the advancement of mechanism in the securities, the listed company's dividend policy is gradually highlighted the important role because the dividend policy has significant effects for listed company through profit distribution on company of financing, financial structure, and future development. While the dividend policy can maintain market stability and protect investors' interests and enhance the competitiveness of enterprises. And now Chinese listed company face two major dividend problemS: first, no Payouts and the Distribution of Dividends are not Continuous; second, dividend Distribution Behavior not Specification

CHAPTER 2 EMPIRICAL ANALYSIS

2.1 Sample and Data Sources

First, These listed companies data select from A-share which listing on the Shanghai Stock Exchange and operating normally, and the time select 4 years from 2013-2016 of the securities regulation of data average as the basic data. Second, the company select exclude financial and insurance industry as well as the ST companies. Finally, using SPSS 21.0 to analysis the those data.

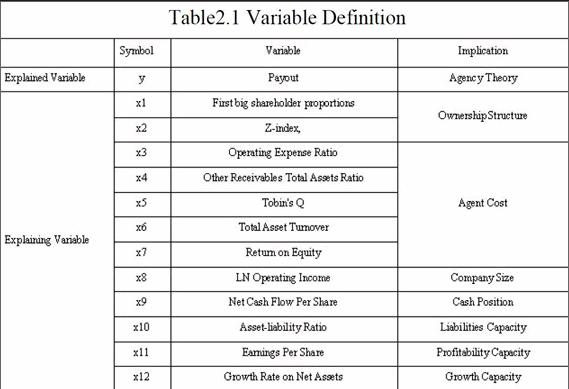

2.2 Variable Define

Table2.1 Variable Definition

2.3 Correlation Analysis

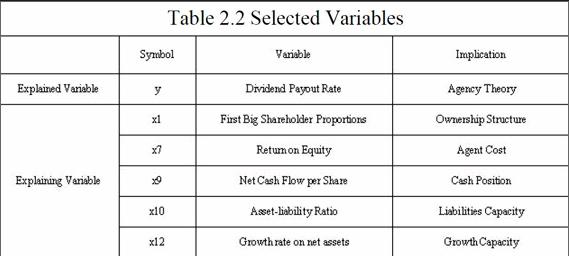

Table 2.2 Selected Variables

After do the correlation analysis, we can get table 2.2, which is the final selected variables.

2.4 Regression Analysis

1. Assumption

According to the above analysis, present the following assumption:

Ho:k1=k2=...=k5=0

H1:ki incompletely equal to zero(i=1,2,...,5)

2. Establish Regression Equation

According to the table 3.2, establish following regression equation:

y=b0+b1x1+b2x2+b3x3+b4x4+b5x5+e

3. Regression Analysis

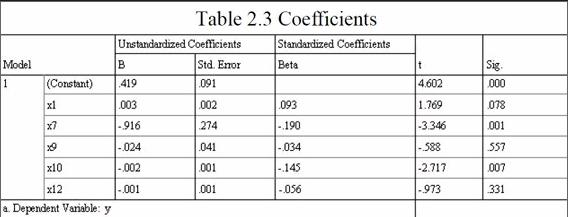

Table 2.3 Coefficients

Data sources: RESSET (www.resset.cn)

According to output of SPSS analysis,put out the regression equation: y=0.419+0.003x1-0.916x7-0.024x9-0.002x10-0.001x12

Table 2.4 Model Summary

Data sources: RESSET (www.resset.cn)

According to the table 2.4 above, R^2 equals to 0.082 shows that dividend payment rate in variation can explain 8.2% by multiple linear regression equation.

CHAPTER 3 CONCLUSIONS

1.About Agent Cost.Studies have shown that the formulation of dividend policies of listed companies in China is still under the influence of agent cost, Chinese regulators to optimize dividend would partly reduce agency costs impact on dividend policy, but there has been no distribution or less distribution of listed companies in China, policy making cannot stop this situation continue to occur.

2. Agency Theory.Except for agent cost, the company of equity structure, the cash status, the liabilities capacity and the growth capacity can affect the constitute of dividend policy of listed companies in different degree, in which agent cost and liabilities capacity can largely effect the constitute of dividend policy.

3.About Ownership Structure.Studies show that Chinese listed company after the share reform has to a certain extent overshadowed that the first shareholder impact on dividend policy, but has not completely eliminated. So the first big shareholder proportion remains a serious problem.