Life in the‘New Normal’

2015-11-25SlowdownafflictedcompaniesadvisedtostoprestingontheirlaurelsandtoseeknewgrowthByDengYaqing

Slowdown-afflicted companies advised to stop resting on their laurels and to seek new growth By Deng Yaqing

Life in the‘New Normal’

Slowdown-afflicted companies advised to stop resting on their laurels and to seek new growth By Deng Yaqing

As China’s economic growth slows, Chinese enterprises are increasingly aware of the fact that they are confronted with a new round of opportunities and challenges as well as fiercer competition.

Back in August, the China Enterprise Confederation/China Enterprise Directors Association (CEC/CEDA) released a report on the Top 500 Chinese Enterprises in 2015. Almost all the listed companies are industrial frontrunners or local backbone businesses, with total operation revenue standing at 59.5 trillion yuan ($9.38 trillion), equivalent to 93.8 percent of the nation’s GDP in 2014.

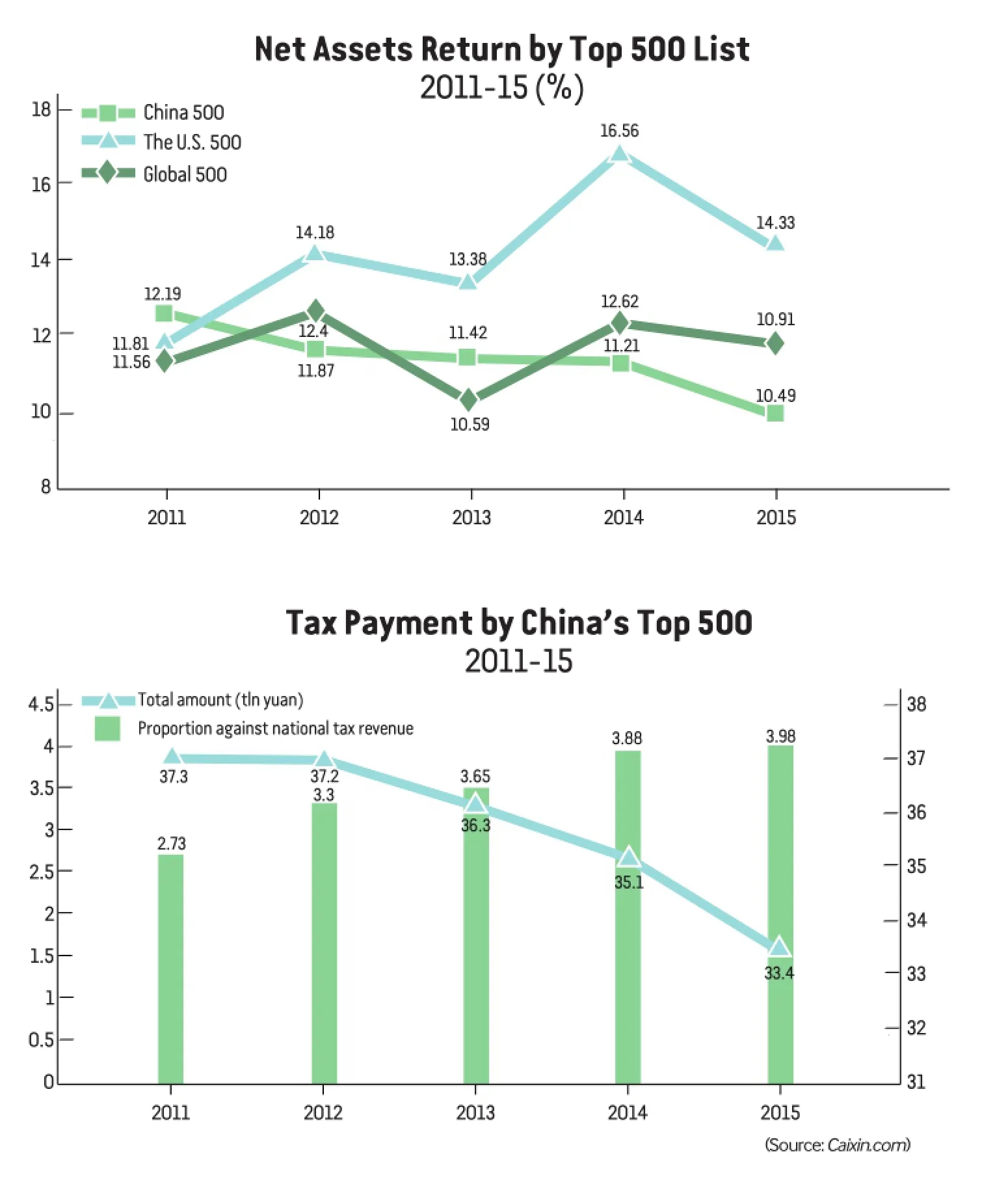

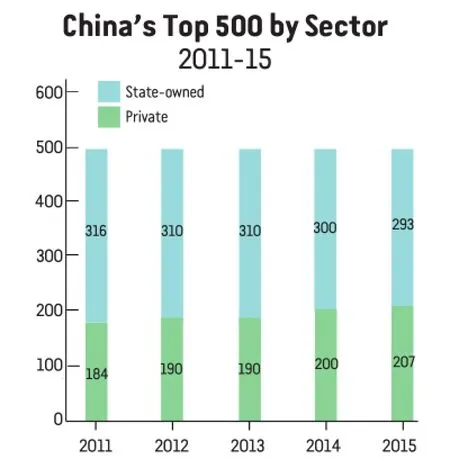

According to the report, the Top 500 Chinese Enterprises list is composed of 293 state-owned companies and 207 private companies. Although private players have seized over 40 percent of the seats andshown a tendency toward expansion, they are lagging far behind their state-owne counterparts in terms of operation revenue assets, profits, tax payment and employe numbers.

Construction takes place on a project commissioned by Sinopec, a state-owned petroleum and petrochemical conglomerate that topped the 2015 list of Top 500 Chinese Enterprises list, in Jiujiang, east China’s Jiangxi Province

In 2014, these leading companie persisted in transforming developmen models, carrying out restructuring an intensifying reforms while trying to pursu growth and expansion, said Wang Zhongyu President of the CEC/CEDA, who recog nized that inspiring results have bee achieved in innovation, structural upgrad ing, international status, etc.

As far as the Top 500 Chinese Enterprise in 2015 are concerned, research and de velopment (R&D) expenditure totals 62 billion yuan ($97.87 billion), up 8.7 percen with average R&D intensity standing at 1.2 percent and the number of patents and pat ents for invention growing 12.6 percent an 14.2 percent, respectively. Moreover, 94 o them have nudged their way into the Globa 500 list, and the proportion of enterprise engaged in advanced manufacturing an modern service industries is on the increase

While total revenue harvested by th Top 500 Chinese Enterprises in 2015 ac counts for 93.8 percent of China’s GDP i 2014, the Top 500 American Enterprise see their revenue amounting to $12.5 trillion, accounting for 77.3 percent of th nation’s GDP, which indicates that China large companies are playing a bigger role i the national economy, according to a repor jointly compiled by Feng Liguo at the CEC/ CEDA and Li Suyun, an economist at the State Information Center under the National Development and Reform Commission.

The stark truth

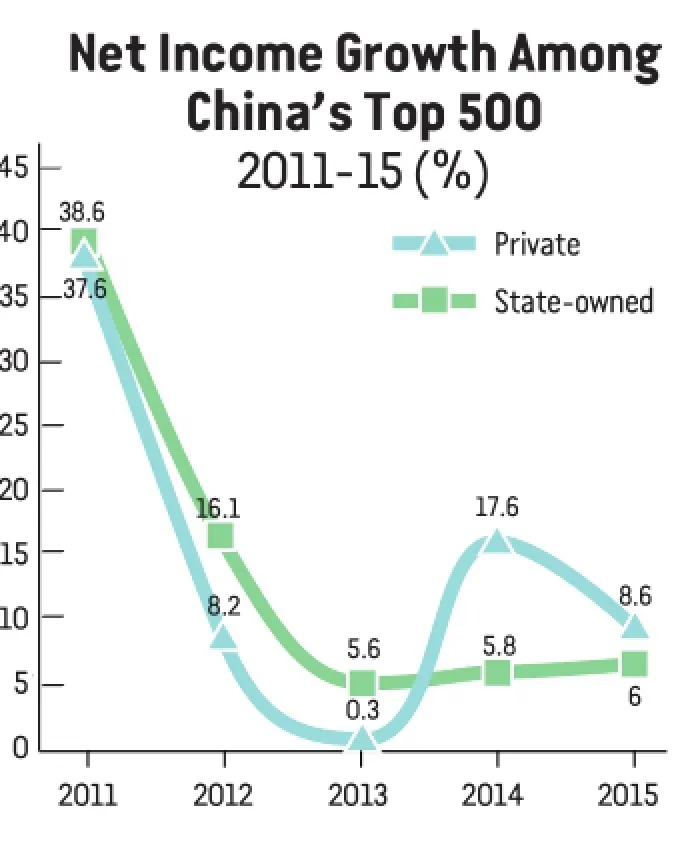

As the report suggests, expansion is decelerating. Total operation revenue of the 2015 Top 500 Chinese Enterprises is just 4.94 percent more than that of the 2014 Top 500 list, a record low in history. The threshold for these finalists has risen to 23.61 billion yuan ($3.72 billion), up a scanty 750 million yuan ($118.2 million) from the previous year, the slowest growth within the past five years. Total assets of the 2015 finalists have reached 197.6 trillion yuan ($31.14 trillion), a 12-percent increase from the previous year, the slowest pace within the past few decades.

Profit growth is also descending. The net profit of the 2015 Top 500 Chinese Enterprises totaled 2.58 trillion yuan ($406.61 billion), representing a 7.3-percent increase, much slower than the 10.6 percent registered last year. Of those, 57 are in the red, with the ratio of loss-incurring enterprises standing at 11.4 percent and total losses hitting 80.39 billion yuan ($12.67 billion). Ninety-four of the Top 500 have experienced negative growth in operation revenue, while 169 have experienced negative growth in net profits.

Both indexes suggest the camp of enterprises operating at a loss is growing and profitability is declining. Though general profit ratios have risen slightly to 4.33 percent from the previous year, the return on assets has dropped to 1.3 percent, the fourth consecutive year of decline.

The manufacturing industry has seen its role diminished in profit earning. Of the Top 500 Chinese Enterprises, 266 fall under the category of manufacturers, with an operation revenue of 23.85 trillion yuan ($3.76 trillion) that makes up 40.1 percent of the total. However, the ratio of manufacturing enterprises’ revenue and profits against the total has been on the decline in recent years.

Since the global financial crisis that broke out in 2008, the economic slowdown has caused a decline of product prices and fierce competition due to the rise of costs in labor, finances and environmental protection. These factors, in turn, drag down manufacturers, according to the report presented by Feng and Li.

At the same time, the five major stateowned commercial banks—the Industrial and Commercial Bank of China, China ConstructionBank, Bank of China, Agricultural Bank of China and Bank of Communications—contribute 35.6 percent to the total profit earned by the Top 500 Chinese Enterprises, in stark contrast to the 18.8 percent registered by manufacturing enterprises. As a matter of fact, since 2008, the net profit of the five banks has been twice that of manufacturing enterprises.

In recent years, the Central Government has been committed to reforming the financial system and reinforcing the financial industry to prop up the real economy and the manufacturing sector. However, the expected results—and benefits—have not yet occurred, as the report suggests.

While expenditure on R&D is steadily increasing, the output of scientific and technological innovation is outstanding. Of the Top 500 Chinese Enterprises, 426 provide their statistics on R&D, with a total input of 619.81 billion yuan ($97.68 billion), up 9.37 percent from the previous year, accounting for 46.6 percent of the nation’s total spending on R&D. The ratio of R&D expenditure against revenue is 1.28 percent, the first rebound within the past five years.

Merging and reorganization activities are not as vibrant as before.

Of the Top 500 Chinese Enterprises, 140 carried out 690 mergers and reorganizations, less than the 811 registered in the previous year. Beyond that, revenue harvested from offshore business has been shrinking for three consecutive years. For the 280 companies of the Top 500 which have agreed to provide their overseas business statistics, total overseas revenue clocks in at 6.33 trillion yuan ($997.6 billion), up 2.76 percent year on year but also registering the third year of a sharp slowdown.

Future prospects

Under the “new normal,” those who can’t face up to new challenges will be phased out, said Miao Rong, Deputy Director of the Research Division of the CEC/CEDA, who believes only those who stick to reform and innovation can survive.

As Li Jianming, Vice President of the CEC/ CEDA noted, Chinese enterprises still have a long way to go in improving the quality and effectiveness of growth. Though the profitability of Chinese enterprises is much stronger than that of Japan, France, Germany and Britain, it trails far behind that of the United States.

Among the top 50 profitable companies in the world, the United States occupies 21 seats, while China holds 13 seats. In addition, China’s most profitable companies concentrate in the banking industry, and enterprises contributing to the real economy seem flabby and stagnant, said Li.

Chinese enterprises maintain an advantageous position in heavy and chemical industries, while American companies have an upper hand in modern service and technology-driven industries, said Miao, noting that progress needs to be made in rationalizing and upgrading the industrial distribution.

Amid an economic slowdown, Chinese enterprises need to adapt to an array of new threats and challenges. Abundant low-cost labor is not available these days. According to statistics from the National Bureau of Statistics, people aged below 14 years old make up a mere 16.6 percent of China’s total population, much lower than the world average of 27 percent. What’s worse, it’s predicted that people aged over 60 years old will account for 16.7 percent of the total population. The substantial change in demographic structure will affect the development of over 80 percent of China’s industrial sectors, especially the manufacturing sector, according to the report by Feng and Li.

As China bids farewell to the era of heavy and chemical industries which sustained high-speed economic growth in the past few decades, Chinese enterprises have to undergo a process of de-capacity, industrial upgrading and transformation to meet new consumption demands.

A report published by McKinsey’s Global Institute, titled “Disruptive Technologies: Advances That Will Transform Life, Business, and the Global Economy,” puts forth a list of 12 disruptive technologies: mobile Internet, automation of knowledge and work, the Internet of Things, cloud technology, advanced robotics, autonomous and near-autonomous vehicles, next-generation genomics, energy storage, 3D printing, advanced materials, advanced oil and gas exploration and recovery, and renewable energy. These technologies mean a potential market reshuffle and renovation of business models. Big companies need to keep up with the times and not settle for resting on their laurels.

Finally, institutional reform needs to be thoroughly carried out. Since most reform measures in the future will touch on the reallocation of benefits and affect interest groups, local governments may be reluctant to catch up with the reform steps of the Central Government. According to a survey conducted by the CEC/CEDA in late 2014, 36.4 percent of respondent enterprises believed the reform has not generated any remarkable results, and 35 percent of them believed initial results had been perceived, but longer-term progress in eliminating administrative monopoly and reforming stateowned enterprises was slow.

One thing’s for certain—the road to survival for Chinese companies is going to be long and grueling but hopefully rewarding in the end. ■

Copyedited by Kylee McIntyre

Comments to dengyaqing@bjreview.com