China textile machinery industry economic operation report 2019:Import and export of textile machinery industry

2020-06-09

According to customs statistics, from January to December 2019, Chinas textile machinery import and export totaled USD 7.116 billion, a decrease of 3.81% year-on-year. Of which: textile machinery imports were USD 3.333 billion, a decrease of 10.49% year-on-year; exports were USD 3.783 billion, an increase of 2.96% year-on-year. The growth rate of exports is significantly greater than the growth rate of imports, and the trade surplus has been maintained since this year.

Overview of imports of textile machinery products

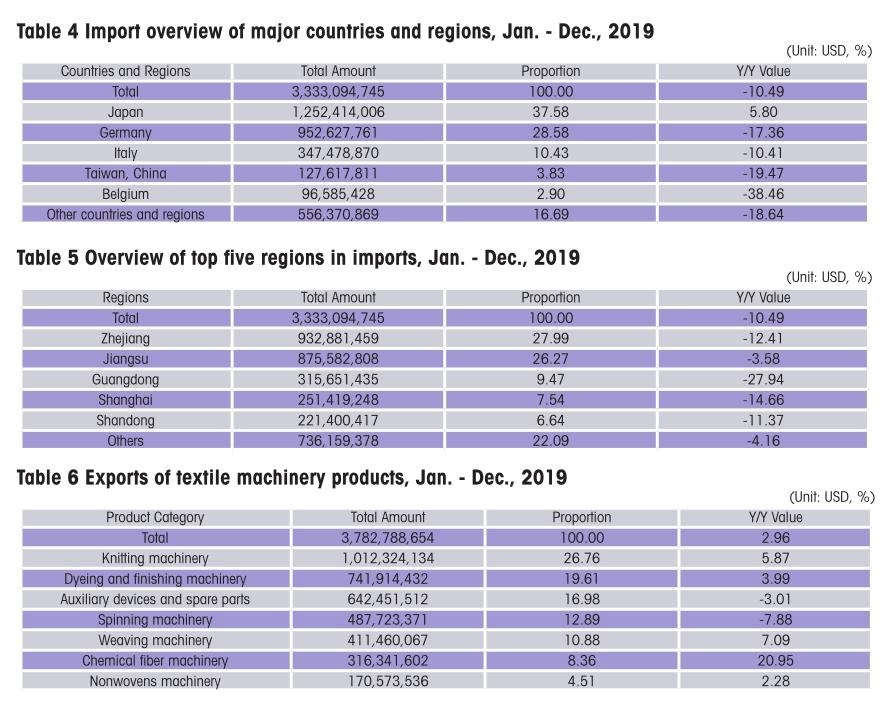

From January to December 2019, China imported textile machinery from a total of 70 countries and regions, with total imports of USD 3.333 billion, a year-on-year decrease of 10.49%.

Import of textile machinery products

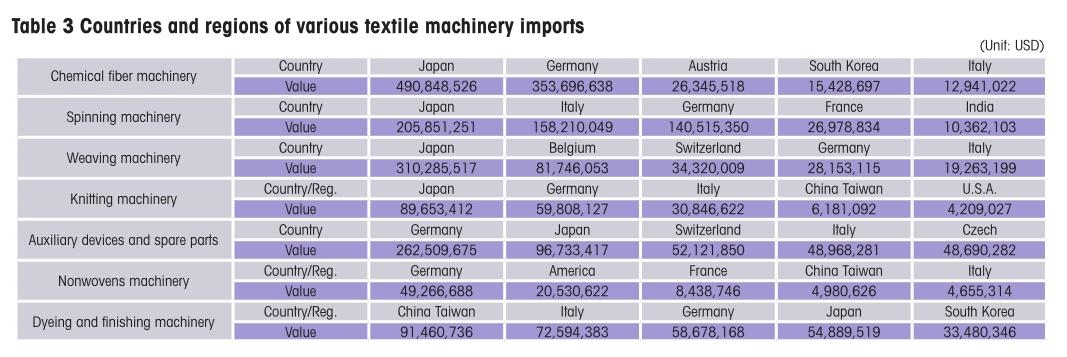

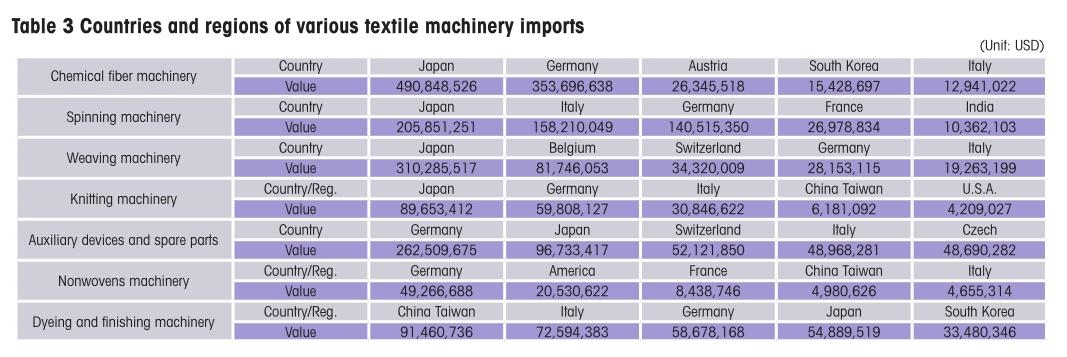

From the perspective of imported product categories, chemical fiber machinery imports ranked first, with total imports of USD 913 million, an increase of 20.44% year-on-year, and accounting for 27.39% of total imports; all seven categories of products except chemical fiber machinery were larger decreased. Driven by downstream demand, chemical fiber machinery continued to maintain a growth trend in imports.

Main countries and regions of textile machinery imports

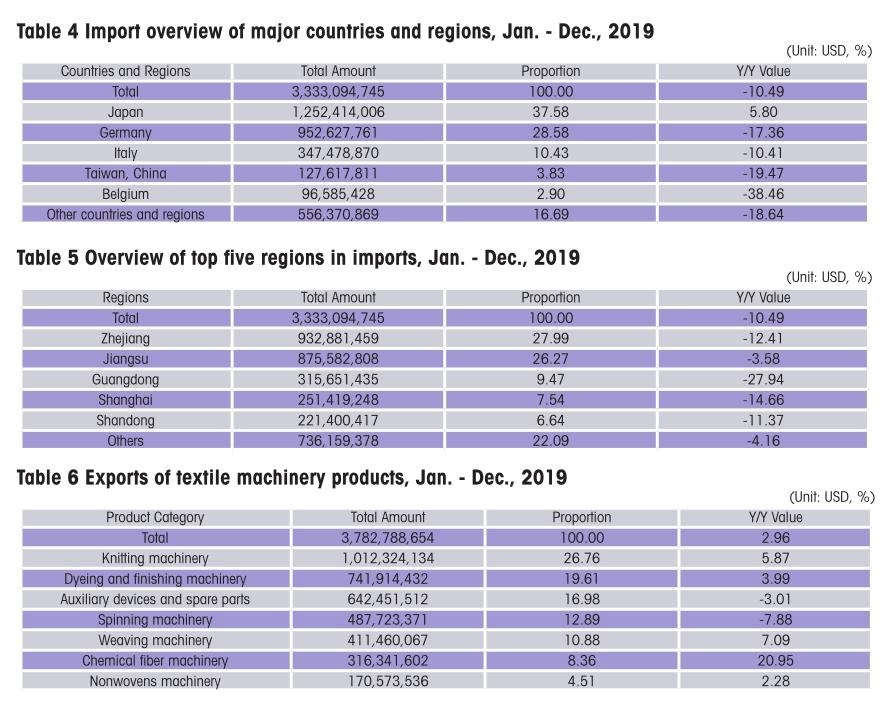

From January to December 2019, Japan, Germany, Italy, China Taiwan, and Belgium were the main countries and regions for Chinas import of textile machinery. The top five imports of trade amounted to USD 2.777 billion, a decrease of 8.65% year-on-year, accounting for 83.31% of the total imports. Since March of this year, the import from Japan has maintained its top position and maintained a positive growth trend.

Textile machinery import regions

From January to December 2019, 28 provinces, municipalities and autonomous regions across the country had different quantities of imports. Zhejiang, Jiangsu, Guangdong, Shanghai, and Shandong, rank among the top five in total imports, accounting for 77.91% of total imports. Zhejiang Provinces total imports ranked first at USD 933 million, a decrease of 12.41% year-onyear, accounting for 27.99% of the total imports. The following Table 5 reflects the top five provinces and municipalities of imported textile machinery.

Overview of exports of textile machinery products

From January to December 2019, a total of USD 3.783 billion of textile machinery was exported to 192 countries and regions, a year-on-year increase of 2.96%.

Export of textile machinery products by major categories

The statistics of the export of textile machinery by customs in January - December 2019 are shown in the Table 6 below. The export value of knitting machinery was USD 1.012 billion, an increase of 5.87% year-on-year, accounting for 26.76%, ranking first, followed by dyeing and finishing machinery, auxiliary devices and spare parts, spinning machinery, weaving machinery, chemical fiber machinery and nonwovens machinery, seven categories of products increased in five categories and decreased in two categories. Chemical fiber machinery exports increased significantly year-on-year.

Main trading partners of textile machinery export

From January to December 2019, China exported textile machinery products to 192 countries and regions. The top five countries and regions in terms of export value are shown in the following Table 8.

From January to December 2019, the total value of exports to India, Vietnam, Bangladesh, Turkey and Indonesia accounted for 53.19% of the total export value. It is the main country and region for Chinas textile machinery exports. Exports to Vietnam have maintained a relatively rapid growth rate, but the growth rate has dropped somewhat from the third quarter.

India has always been our largest trading partner. From January to December 2019, total exports to India were USD 714 million, an increase of 15.67% year-on-year and accounting for 18.88% of all exports. Seven categories of products increased in five categories and decreased in two categories. Chemical fiber machinery, knitting machinery, and Nonwovens machinery rose more than average. Export of chemical fiber machinery to India was USD 50.5355 million, an increase of 102.73% year-on-year, and accounted for 7.08% of Indias total exports. Spinning machinery, dyeing and finishing machinery declined.

From January to December 2019, exports to Vietnam were USD 624 million, an increase of 11.64% year-on-year. It is Chinas second largest trading partner for textile machinery exports, accounting for 16.49% of total exports. Except for knitting machinery and spinning machinery, there was a large increase, and spinning machinery decreased by 32.61% year-on-year. The proportion of dyeing and finishing machinery in total exports continued to increase, accounting for 26.36% of total exports to Vietnam, and exports of USD 164 million.

From January to December 2019, exports to Bangladesh were USD 304 million, a decrease of 10.39% year-on-year and accounting for 8.04% of Chinas total exports. Among them, the export of knitting machinery was USD 151 million, an increase of 74% year-on-year, accounting for 49.61% of the total exports of Bangladesh. The export of flat weft knitting machines was USD 105 million, an increase of 18.10% year-on-year, accounting for 69.67% of the knitting machinery. Exports of dyeing and finishing machinery, spinning machinery, and weaving machinery showed a downward trend.

From January to December 2019, exports to Turkey were USD 186 million, an increase of 5.17% year-on-year, and accounting for 4.90% of total exports. Among them, the export of chemical fiber machinery was USD 67.2396 million, an increase of 138.78% year-on-year, accounting for 36.25% of the total export value of Turkey. The export of synthetic fiber spinning machine reached USD 13.3693 million, an increase of 267.96% year-on-year, accounting for 19.88% of Turkeys export of chemical fiber; the export of chemical fiber textured machine machines was USD 46.8889 million, a year-onyear increase of 122.93%, accounting for 63.73% of Turkish chemical fiber exports. With the adjustment of the global textile industry layout, since this year, the export of chemical fiber machinery to Turkey has maintained a significant growth trend. The export of nonwovens machinery and knitting ma- chinery has fallen relatively.

From January to December 2019, exports to Indonesia were USD 185 million, a decrease of 4.73% year-onyear, and accounting for 4.88% of total exports. Among the products exported to Indonesia, the export of spinning machinery was USD 36.4889 million, an increase of 42.41% year-on-year and accounting for 19.76% of the total exports to Indonesia. The export of cotton fiber carding machines was USD 8.6557 million, a year-on-year increase of 912.71%, accounting for 23.72% of the export of spinning machinery; other open-end rotor spinning machines exported USD 14.9454 million, a year-on-year increase of 277.02%, accounting for Indonesias spinning machinery exports 40.96%. The relative decline of weaving machine export is large.

The amount of textile machinery exported to countries and regions along the “Belt and Road” was 2.808 billion yuan, accounting for 74.24% of all exports. It is the main market for Chinas textile machinery exports, with significant increases in Central Asia, West Asia and North Africa. The following table reflects the situation of textile machinery products exported to countries and regions along the “Belt and Road”.

Export of textile machinery

From January to December 2019, a total of 30 provinces, municipalities and autonomous regions have exported textile machinery products. The top five provinces and municipalities accounted for 85.23% of the total exports, as shown in the following Table 10.

Industry situation outlook

Global economic growth is slowing in 2019, there are many external uncertainties, domestic cyclical problems and structural contradictions are superimposed, and Chinas macroeconomic downward pressure continues to increase. The textile industrys export market has undergone adjustments, and the potential of the domestic demand market needs to be further tapped. Enterprises are still cautious in investing. Affected by this, the overall operation of Chinas textile machinery industry has shown an adjustment trend, and the performance of the export market is better than the domestic market.

2020 is the year when a well-off society will be fully established and the“13th Five-Year Plan” ends. From the perspective of the global economy, the factors restricting economic growth have not yet shown signs of certainty improving, and the momentum of endogenous growth has weakened. The global pandemic of COVID-19 has had a certain impact on Chinas economic development. Demand and production have slowed down, consumption and investment have been sluggish, and the industry is facing huge challenges. It will take some time for the economy to recover from full operation to a normal state of operation. The industry has recently been gradually recovering, but at the same time, in order to alleviate the difficulties caused by the pandemic, the state and local authorities have issued a number of support policies to help boost the market confidence. In the long run, the fundamentals of Chinas economy are still stable, and the development of the industry is still resilient. The industry needs to work harder to improve internal quality, improve product quality and development capabilities, strengthen international competitiveness, and ensure that the industry moves forward steadily.

杂志排行

China Textile的其它文章

- Dear readers

- Global anti-pandemic

- Dr.Christian Schindler:Our confidence in battling the COVID-19 in the world’s textile industry

- Under the pandemic,countries around the world become more intertwined

- CCPIT provides key material supply and demand information to more than 20 countries and injects positive energy into global pandemic resistance

- China exports 21.1 billion masks since March