The Rise of Chinese Cosmetics Consumers

2018-02-20ChinaInformationCenterofDailyChemicalIndustry

China Information Center of Daily Chemical Industry

It is well-known that China is an important manufacturing and production center for the global economy.But the country is now also a globally significant consumer market. The boom of cosmetics industry in China has brought about changes in consumer behavior.The consumer awareness and purchasing power of Chinese consumer keeps growing. This is reflected in the following:

1) Consumers have more freedom of choice. With more choice, consumers have the freedom to choose the best product for them. Consumers can buy online as well as in the physical stores. The freedom of consumption has increased unprecedentedly.

2) The purchasing power of Chinese consumers,particularly urban consumers increased. Annual per capita income in Chinese urban areas has seen a significant rise over the last two decades. In 2017,per capita disposable incomes of urban households in China had amounted to 36,396 yuan. Especially, the purchasing power of post-90s and post-00s is rising.

3) The promotion of consumer awareness and consumption proposition. Older consumers may value price over quality, but younger generations are increasingly willing to pay premiums for higher-end products. In the past, consumers can get information about the newly launch products. With the use of television,consumers are well informed and persuade about the product that the companies launch. Nowadays,consumers become more rational and have their own consumption ideas, the dominance of TV's influence shrunk significantly.

According to Euromonitor International's estimates,from 2016 to 2019, retail sales in China's skincare and cosmetics products market will remain at an average annual growth rate of 12.8%, much higher than the global average of 6.0%, and will top RMB 287 billion yuan in 2019. These data prove the rise of Chinese consumers.

Chinese cosmetics consumers are generally not very loyal to brands. “You don't need to choose a product because it belongs to a brand, for each product you have to find the one that better fits your skin; it does not always have to be from the same brand” explains Ren, a 31-yearold woman. Chinese consumers like to try several brands to compare them. Another characteristic of Chinese cosmetic consumers is that they exhibit seasonal consumption of products. In Shanghai specifically, due to the significant difference in climate between winter and summer months, Chinese people change their habits according to the season. In summer, they will use more sunscreen cream to preserve the whiteness of their skin, and less thick and oily cream than they do in winter months.

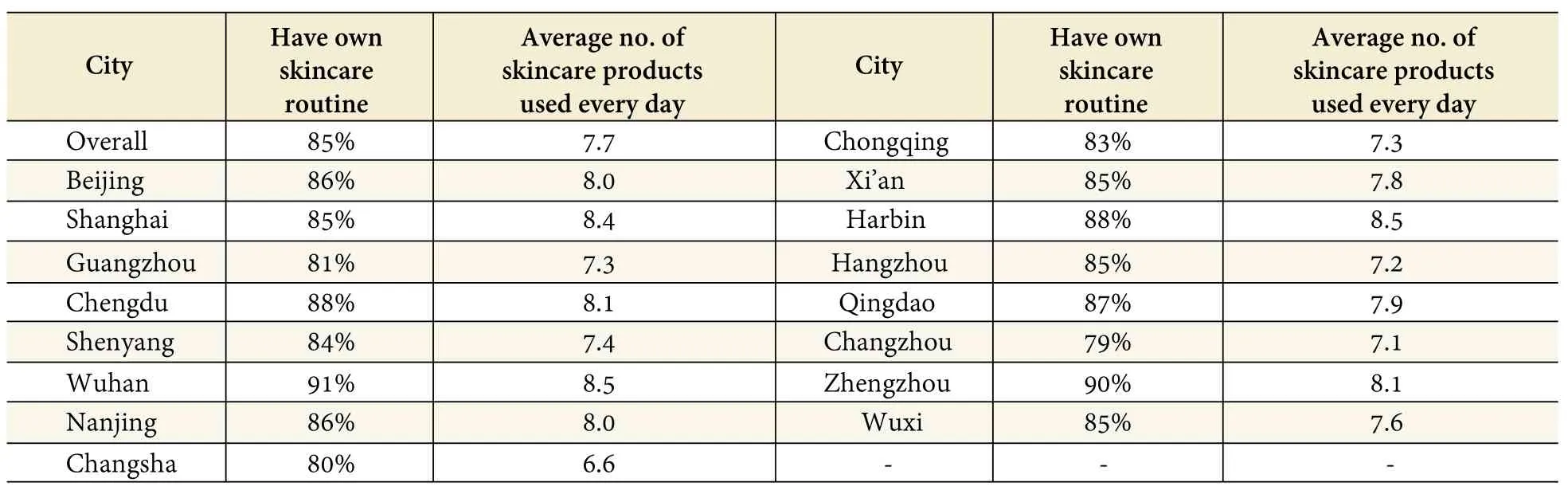

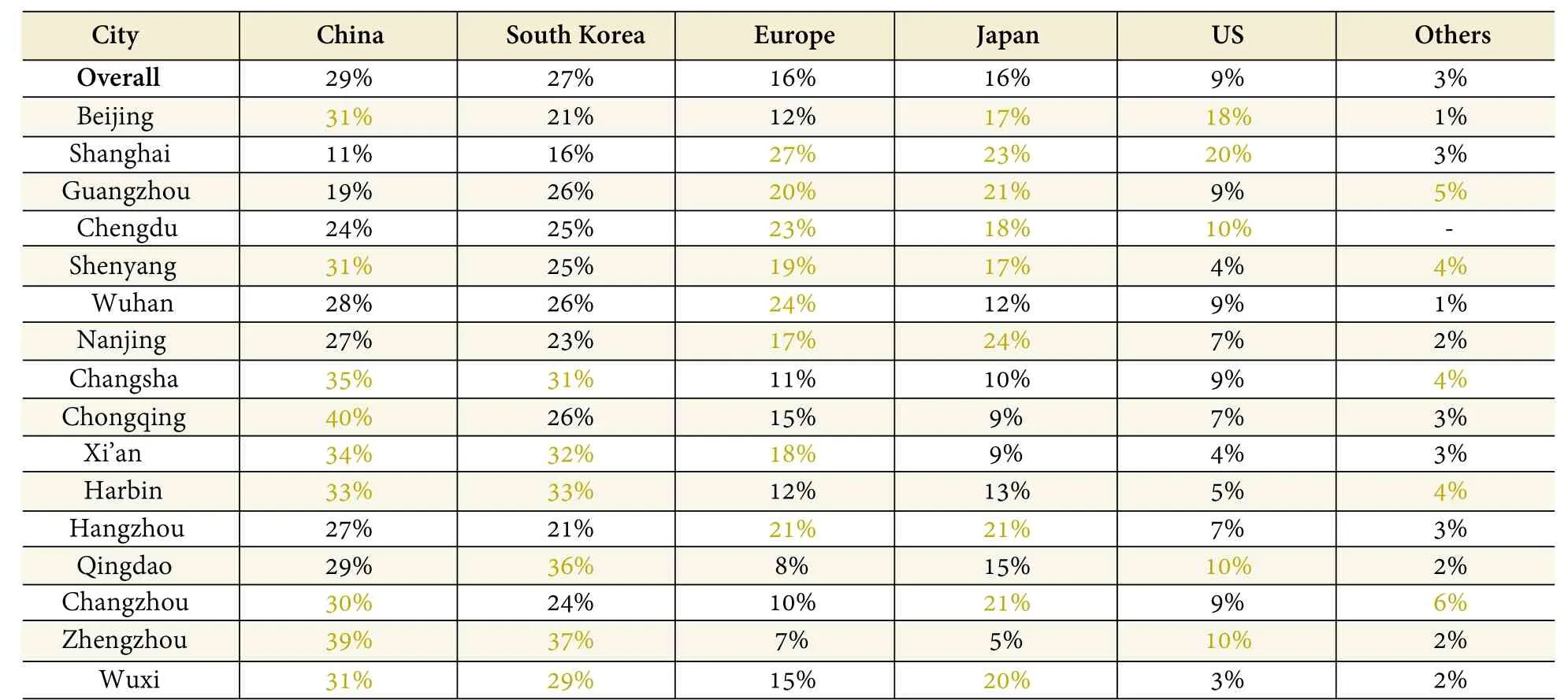

Table 1. The status quo of cosmetics use by women in different cities

Consumption characteristics of women at different ages

Previous research indicated that female's spending on cosmetics still making up of the main income for the entire cosmetics market. In order to get a good understanding of the characteristics and development trends of this market, HKTDC Research conducted a series of company visits, consumer focus group discussions and an online questionnaire survey. The survey constituted an in-depth study into the spending mentality, consumer preferences, purchase considerations and purchase channels of Chinese consumers of skincare and cosmetics products.

This survey targeted two groups of female respondents, namely young (aged 20~30) and mature(aged 31~45). Overall, 85% of the women surveyed have their own daily skincare routine, which shows that there is a strong awareness of skincare. At the same time,the products they use for taking care of their skin are diversified and not only restricted to cleansing milks,lotions or face creams. They would also use different products for their morning and evening skincare routines.On the whole, the average respondent uses 7.7 different skincare products every day (Table 1).

For the younger respondents, their morning skincare involves fewer steps and an average of 2~4 different products. Some respondents said that in the morning after they have finished their skincare routine they still have to spend time doing their makeup, so their morning skincare tended to consist of a few basic steps. In the evening, however, they could afford a more thorough skincare routine, using a greater variety of products and going through more steps. Contrastingly, the number of skincare steps taken and number of skincare products used by mature female respondents were found to be more or less the same in the morning and evening, involving 6~ 8 different products each time (Figure 1) . According to the more mature participants in the focus group discussions conducted, due to their age they tend to pay greater attention to each skincare step and the products they use are more refined and targeted. Not surprisingly,the number of skincare steps taken is also greater. Their hope is to delay aging of their skin and maintain its radiance and elasticity.

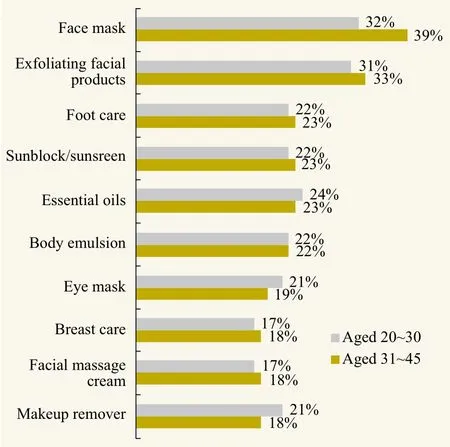

Figure 1. Everyday skincare products used by Chinese women on a daily basis

As regards certain skincare products which are not for everyday use and may require a longer time to apply,respondents said they would only use them on a periodic or needs basis. Examples include peeling cleansers, body essential oils, and foot care products. This shows that female consumers attach great importance to other parts of the body other than the face. They are also looking for products with increasingly specific benefits.

Figure 2. Skincare products used periodically on needs basis

According to Figure 1, cleansing products ranked first with 93 percent of respondents aged 20 to 30 and 92 percent of respondents aged 31 to 45. According to Figure 2, facial mask ranked first with 32% (interviewees aged 20 to 30)and 39% (interviewees aged 31 to 45). It can be seen that cleansing products are currently the most commonly used products for Chinese women, and facial mask has great potential in the future market.

Young women start skincare habits early

The survey finds that the young respondents tend to have a high awareness of skincare and start skincare routines earlier in their lives than the more mature respondents did. The reason given by young respondents for their skincare efforts is the desire to look beautiful.They also hope to “solve skin problems” through their daily skincare regimen, especially puberty related skin problems such as acne, clogged pores, oily skin or dry skin. Some new generation respondents said: “[When I was] at junior high, [my] mom already taught me how to use face cleansing and moisturising products”, and“at university, all girls have their own daily skincare products.”

In recent years, the Chinese skincare products market has become increasingly mature, offering a wide range of skincare product brands and product categories, which has made it easier for the new generation to develop skincare habits. Compared with the younger generation,mature respondents only started skincare routines after they started working and had the purchasing power.Although the reason given by mature respondents for their skincare routines is also the desire to look beautiful,they are more eager to delay the aging of their skin so that they can “look younger” (Figure 3).

Figure 3. Reasons why skincare is a must for women

Women in different age groups have different expectations of the condition of their skin. Therefore, they have different requirements on the efficacy of skin care products. Young respondents mainly take care of their skin in order to solve skin problems, so they primarily look for products to control oil, tighten pores and whiten skin. As for the more mature respondents, their priorities tend to be skin firming, anti-wrinkle actions, and spot removal (Figure 4).

Figure 4. Expected benefits of skincare products

Skincare sets well received

Overall, 37% of the respondents prefer using skincare sets of the same brand mainly because they can use the whole set of products and follow the steps suggested by the brand directly. They also believe that this is likely to produce better results. A high proportion of respondents(46%) would, on the basis of using skincare sets of a certain brand, add other products of the same brand. Only 17% of the respondents like to mix and match products of different brands and different sets. This shows that most respondents have a preference for certain skincare product brands and brand loyalty is high.

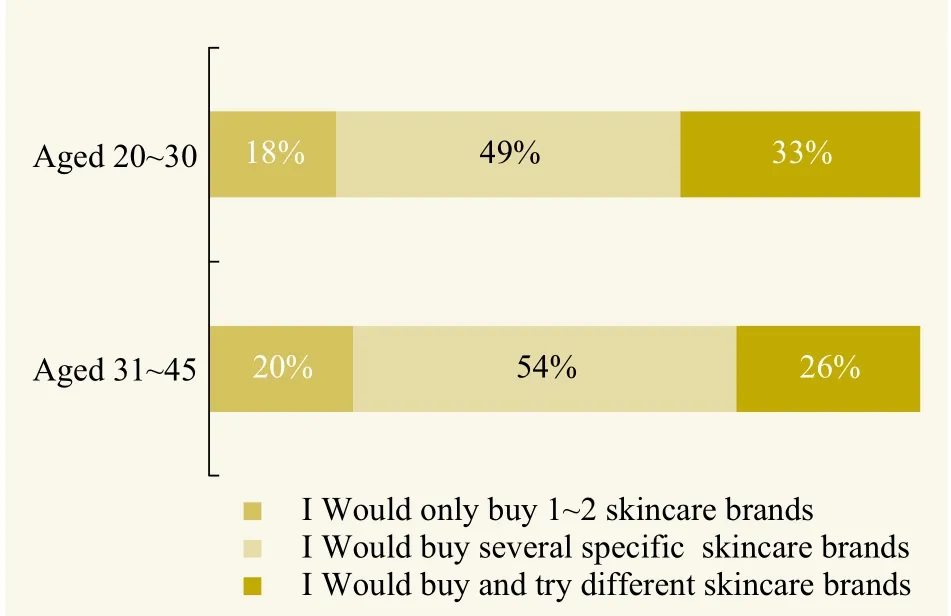

The survey also finds that about half of the respondents would stick to several specific brands when it comes to buying and using skincare products. Among the young respondents, 33% indicate that they would buy and try different brands of skincare products in order to find products that better suit their skin and offer value for money. Since young consumers generally do not have a high income, they are easily persuaded or attracted to make purchases and stock up on products when there are promotional offers. As for the more mature respondents,usually after they have identified a brand that suits them,they are less eager to try other brands. Some mature respondents participating in the focus group discussions pointed out that the skincare products they use are famous global brands or considered to be among the best products of their kind, so they do not feel the need to look for or try other brands.

Figure 5. Skincare products brand loyalty

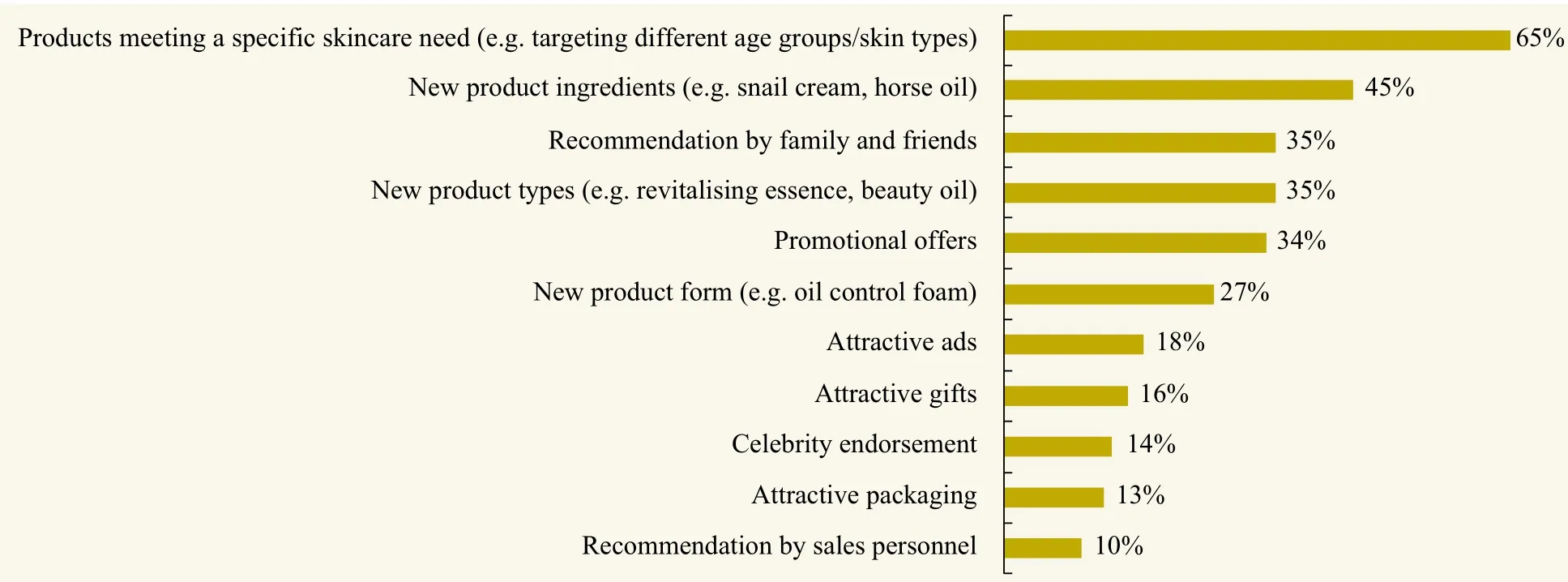

Offering unique products can attract consumers

Generally speaking, the brand loyalty of respondents for skincare products is high, while benefit-based product segmentation is increasingly evident. Therefore, when a new brand enters the Chinese market, offering unique products is the only way it can attract consumers to try and buy. The factor that most attracts respondents to buy a new brand is “products meeting a specific skincare need”(65%), such as targeting different age groups, different skin types, and with specific benefits (such as anti-aging,anti-wrinkle actions or stimulating collagen production).Coming second is “new product ingredients” (45%), such as snail cream, horse oil or lanolin(Figure 6).

Chinese and Korean skincare brands are most popular

Skincare product brands in China market are becoming increasingly diversified. Apart from Chinese brands, a great number of foreign brands have made their way onto the Chinese market. In recent years, Korean culture stormed China, and Korean products are widely popular and followed by Chinese young generations. Among the young respondents, 31% say they mostly purchase Korean skincare brands, followed by Chinese brands (30%). But for the more mature respondents, it is the other way round: they mostly buy local brands (29%), followed by Korean brands (23%). It is interesting to note that mature respondents buy considerably more European (18%), Japanese(16%) and US (11%) brands than young respondents (Table 2).

Figure 6. Considerations when buying new skincare brands

Table 2. Origin of most purchased skincare product brands

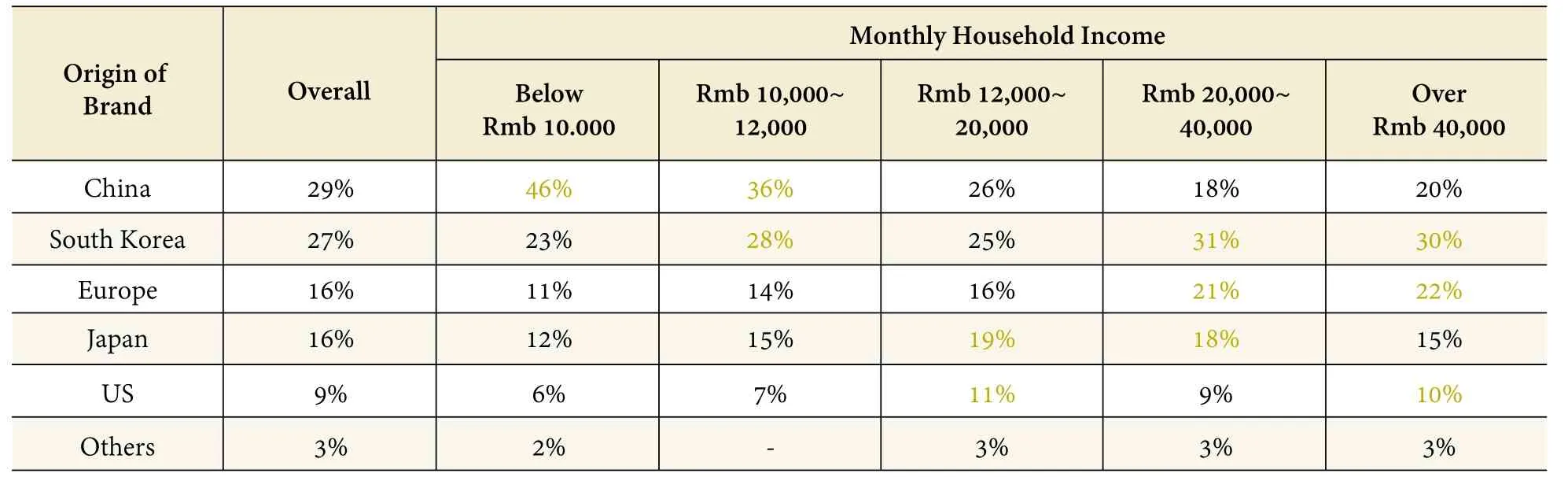

The price of imported skincare brands is higher than that of local brands. In other words, the purchasing power of a consumer affects her choice to a certain extent. In terms of income, the proportion of respondents with a monthly household income of under RMB 20,000 buying Chinese skincare brands is higher than the average, as is the proportion of respondents with a monthly household income of over RMB 20,000 buying European brands.Meanwhile, in terms of price, the average price paid by respondents with a monthly household income of less than RMB 20,000 is about RMB 212 for toner and RMB 235 for face cream, compared to the average RMB 354 and RMB 382 paid for those products, respectively, by respondents with a monthly household income of over RMB 20,000 (Table 3).

According to interviews with Chinese skincare and cosmetics products distributors, Chinese consumers have formed a certain impression of skincare and cosmetics product brands from different countries or regions even if they have not actually used these products themselves. For instance, consumers generally have the perception that Swiss brands focus on medical cosmetology, US brand products have more advanced formulae and that Japanese brands specialize in whitening and are more suitable for the skin of Asians.

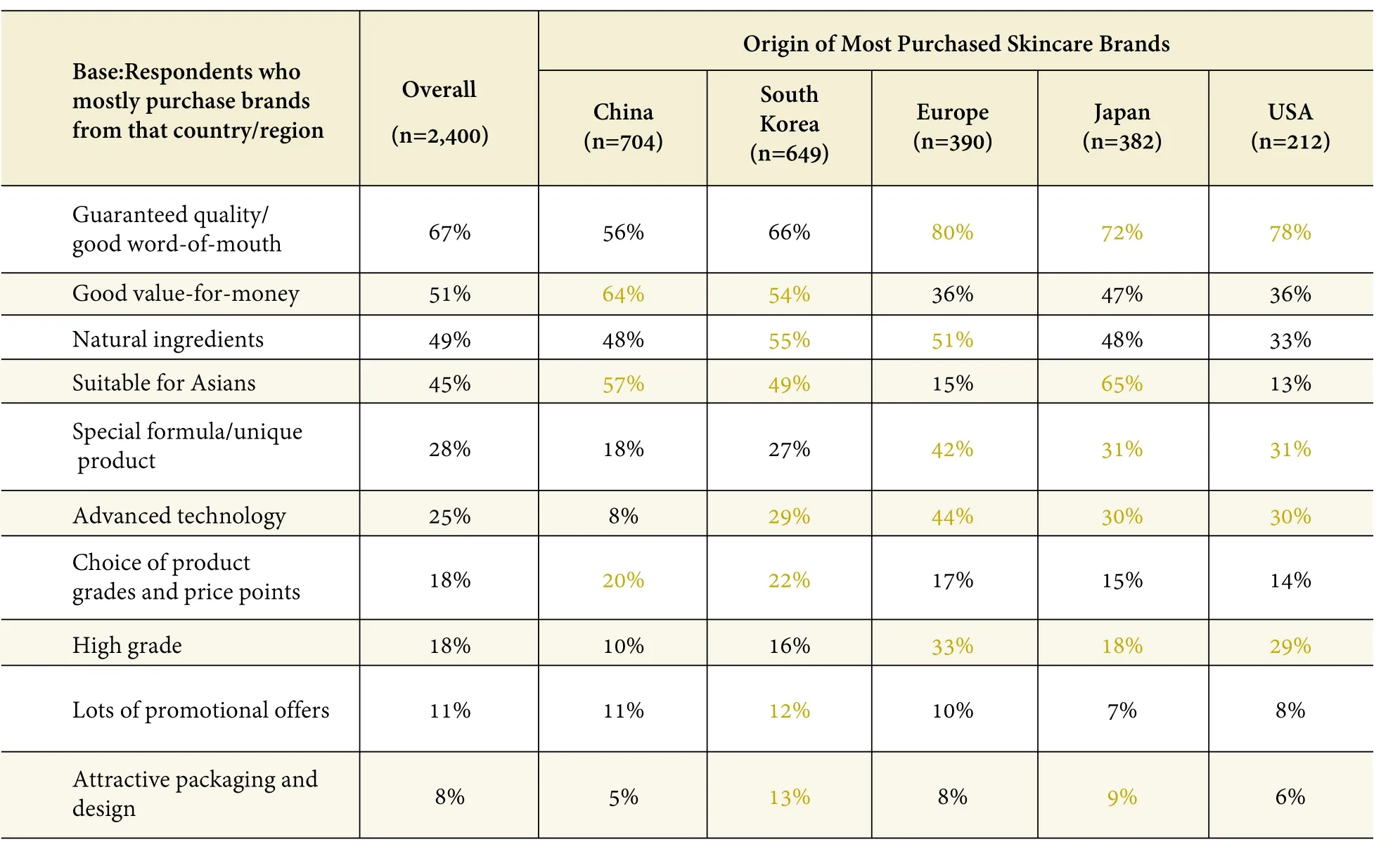

Overall, female consumers' three main considerations when buying skincare products are: guaranteed quality /positive word-of-mouth reputation (67%), good value for money (51%), and natural ingredients (49%). Among the respondents who mostly purchase Chinese skincare brands,64% indicate that mainland brands are good value for money and are more suitable for Asians (57%). Among respondents who mostly purchase European brands, 80% say that skincare products from European brands offer guaranteed quality and that their ingredients are natural (51%) (Table 4).

Table 3. Origin of most purchased skincare product brands

Table 4. The brand origin factor of most purchased skincare brands

Male consumers

The men's cosmetics sector exhibits strong growth, in particular skincare products for men. More and more male consumers are receptive to men's skincare and make-up products. In 2016, male accounted for 52.2% of Chinese total population. However, the share of cosmetic products for men in the overall cosmetics market is relatively small.Oil-control and cleansing are the two major concerns.While facial cleansers take the lion's share of the male market, demand for specialty products like masks, sunblocks and those with whitening and moisturising functions is also on the rise. This demonstrates that male consumers are paying more attention to skin conditions such as aging and coarseness.

Products trend

There is a distinct preference in China towards cosmetic products using natural ingredients. Chinese consumers fear the risks of chemical products and are strongly convinced that natural products are more efficient that chemical ones.

Cosmeceuticals, especially Chinese herbal cosmetics,are opening up a new territory in the cosmetics market. It is understood that more than 170 enterprises have tapped into China's cosmeceuticals market to date, many of them renowned pharmaceutical companies in China, such as Tongrentang and Yunnan Baiyao. Cosmeceuticals only have a market share of about 20% in China at present. In Europe, the US and Japan, cosmeceuticals have a 50%~60%share. It is believed that China's cosmeceuticals market has much room for development. As young consumers begin to concern themselves with the ingredients and quality of products, consumption of cosmeceuticals tends to start at increasingly early ages. While cosmeceuticals have medical properties, they are classified as cosmetics since there is still no official definition for the term ‘cosmeceuticals' in China. According to the Regulations on Cosmetics Hygiene Supervision, no medical jargon or claims of medical efficacy should be used in cosmetics items' packaging or instructions.

China's beauty products market is trending towards the high-end

Premium cosmetics brands have done better than mass cosmetics brands in the China market. Euromonitor figures show that the 2016 market shares of high-end skincare products far outstripped that of mass market fast-moving alternatives. Consumers favour major international brand skincare products, and spending habits are switching from price-focused to quality and brand driven.

A market driven by online commerce and social media

The rapid growth of online shopping and accelerated penetration of mobile devices have enabled social media to become an important marketing tool for brands to promote their products and interact with their customers.

China is one of the most important markets for the sale and distribution of beauty products online. Over the next five years, e-commerce could become an even more important retail channel in China. This channel of distribution has become a lever facilitating purchases for individuals.

There are generally four online selling platforms for skin care in China:

1) Self-operated online platforms;

2) Online stores on third-party integrated e-commerce platforms such as Tmall, JD.com and Amazon;

3) Third-party online cosmetic platforms such as Watsons or Sephora;

4) Cross-border e-commerce platforms such as Tmall Global, JD Worldwide.

Mobile e-commerce, which already accounts for 51% of all online sales in China, compared with a global average of 35%, will grow even faster. On Taobao, a Chinese e-commerce marketplace, the share of sales transacted though mobile devices rather than PCs rose from 51% to 62% within the first three quarters of 2015.By 2020, mobile e-commerce is projected to account for 74% of all online sales in China.

Moreover, Chinese online cosmetic shoppers consider search engines as an important part of their purchasing process,especially Baidu.Baidu is the China's largest search engine with over 600 million users monthly and 80% market share. Before making their purchase decision, Chinese cosmetics shoppers carry out a deep search on Baidu to collect information about the brand, the product, the functions and effectiveness of the product and where to buy it.

Conclusion

Chinese consumers are increasingly trading up from mass products to premium products. The growing role of richer, younger, Internet-savvy consumers will boost demand for different kinds of products purchased through different kinds of retail channels. E-commerce will propel Chinese consumers to purchase different kinds of products-and in greater variety. Regardless, the power of Chinese consumers promises to remain a going economic concern, as they become the largest force driving the global beauty market.

杂志排行

China Detergent & Cosmetics的其它文章

- Alibaba's Tmall and L'Oréal China Partner Up to Launch New Campaign for Men's Grooming Products

- Pechoin Wins the Innovation Golden Award at the 30th IFSCC Congress in Munich

- Coming Soon on Tmall: Boots Makes First Move into China

- IFF's New Naturals Lab in China Is the First Outside of the US

- 2018 CCIA Annual Meeting &Industry Convention Successfully Held in Zhuhai

- Major Industry Events